The ATR Trailing Stop: A Powerful Tool for Trade Management and Trend Definition

Understanding market trends and managing trades effectively are crucial components of successful trading in the financial markets. Traders often rely on various technical indicators and tools to aid them in decision-making and risk management. One such tool that has gained popularity among traders is the Average True Range (ATR) Trailing Stop.

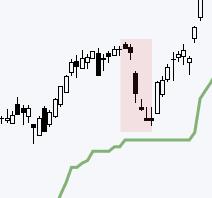

The ATR Trailing Stop is a dynamic stop-loss mechanism that adjusts based on the volatility of the market. It helps traders establish reasonable exit points for their trades while also providing a better understanding of the underlying trend. By incorporating the ATR Trailing Stop into their trading strategy, traders can effectively manage their risk and maximize their profit potential.

Setting up an ATR Trailing Stop is relatively straightforward. The first step is to calculate the ATR value based on a specified period – usually 14 days. The ATR value represents the average range of price movements over the selected period, giving traders an indication of market volatility. Once the ATR value is determined, traders can then use a multiple of the ATR value to set their trailing stop level.

For example, if the ATR value is 20 points and a trader decides to set their trailing stop at two times the ATR value, the trailing stop level would be set at 40 points away from the current price. As the price moves in the trader’s favor, the trailing stop will adjust accordingly, always maintaining the specified distance from the highest price reached.

One of the key benefits of using the ATR Trailing Stop is its ability to adapt to market conditions. In volatile markets, the trailing stop will widen to accommodate larger price movements, allowing traders to stay in winning trades longer and capture more profits. Conversely, in calmer market environments, the trailing stop will tighten, helping traders lock in gains and protect against potential reversals.

Moreover, the ATR Trailing Stop can also be a valuable tool for defining the underlying trend. By observing the relationship between the price and the trailing stop level, traders can gauge the strength and direction of the trend. If the price consistently stays above the trailing stop level, it is an indication of an uptrend, while prices consistently below the trailing stop suggest a downtrend.

In conclusion, the ATR Trailing Stop is a versatile tool that can enhance trade management and trend identification for traders. By incorporating this dynamic stop-loss mechanism into their trading strategy, traders can better control risk, maximize profits, and gain a deeper insight into market trends. With its adaptability to changing market conditions, the ATR Trailing Stop serves as a valuable asset for traders looking to achieve consistent success in the financial markets.