Unveiling the Power of Technical Analysis in Market Research and Analysis – Part 1

Market Research and Analysis Part 1: Why Technical Analysis is Crucial for Investors

Understanding the inner workings of financial markets is a key component for successful investing. One of the core aspects of market research is technical analysis, which plays a crucial role in helping investors make informed decisions. In this article, we delve into the reasons why technical analysis is essential for investors looking to navigate the complexities of today’s financial markets.

Technical analysis primarily involves the study of historical price and volume data to predict future price movements. By analyzing patterns, trends, and other indicators, investors can gain insights into the potential direction of a particular asset’s price. This information is invaluable for making educated investment decisions and managing risk effectively.

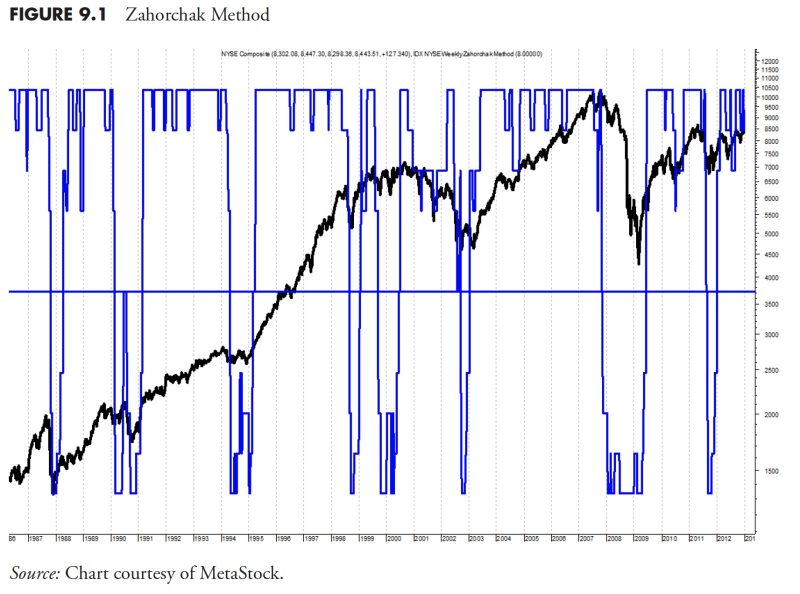

One of the key reasons why technical analysis is so important is its ability to provide investors with a visual representation of market data. Through the use of charts and graphs, investors can quickly identify patterns and trends that may not be apparent through fundamental analysis alone. This visual insight can help investors spot potential opportunities and make timely decisions.

Furthermore, technical analysis can also help investors identify support and resistance levels. These levels indicate the prices at which an asset is likely to encounter buying or selling pressure. By understanding these levels, investors can better time their entry and exit points, thus maximizing their potential returns and minimizing risks.

Another important aspect of technical analysis is the ability to utilize various technical indicators. These indicators provide valuable information about market sentiment, momentum, and volatility. By incorporating these indicators into their analysis, investors can gain a deeper understanding of market dynamics and make more informed decisions.

Additionally, technical analysis can help investors identify trend reversals. By recognizing the signs of a potential trend change early on, investors can adjust their investment strategies accordingly and protect themselves from potential losses. This proactive approach to risk management is essential for long-term investment success.

In conclusion, technical analysis is a crucial tool for investors looking to navigate the complexities of financial markets. By providing visual insights, identifying support and resistance levels, utilizing technical indicators, and spotting trend reversals, investors can make more informed decisions and increase their chances of success. As such, incorporating technical analysis into your investment strategy is a wise and prudent decision that can help you achieve your financial goals in the long run.