Unlocking Profit Potential: Mastering Bullish Gap-Down Reversals for Success

Bullish Gap-Down Reversals: A Lucrative Trading Strategy

Understanding market dynamics and being able to spot profitable trading opportunities are essential skills for successful traders in the financial markets. One such opportunity that savvy traders often look out for is the bullish gap-down reversal pattern. This pattern occurs when a stock or other financial instrument opens significantly lower than its previous close, only to reverse course and rally higher during the trading session. In this article, we will explore how traders can profit from bullish gap-down reversals and capitalize on this unique trading setup.

Identifying Bullish Gap-Down Reversals

The first step in profiting from bullish gap-down reversals is to accurately identify this pattern on a price chart. Typically, this pattern is characterized by a significant gap-down at the opening bell, which creates a temporary oversold condition in the stock. However, instead of continuing lower, the stock reverses course and begins to rally, often closing the gap and moving higher throughout the trading session.

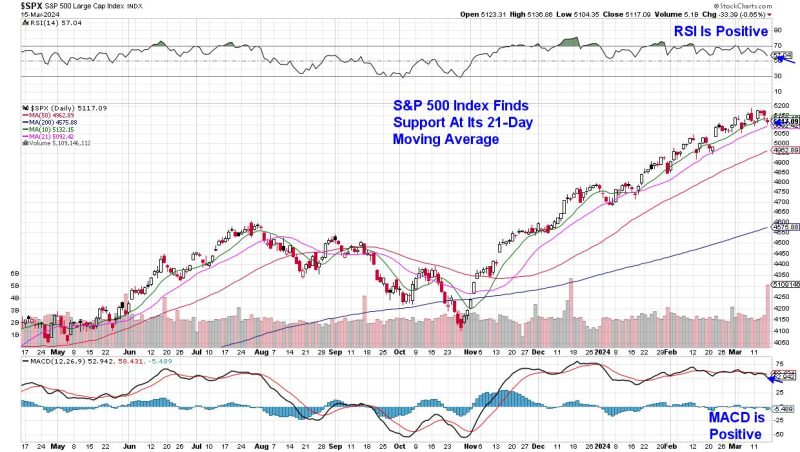

Traders can use technical analysis tools such as moving averages, volume indicators, and support and resistance levels to confirm the bullish reversal. Additionally, monitoring market sentiment, news events, and company fundamentals can provide valuable insights into the potential for a bullish turnaround.

Trading the Bullish Gap-Down Reversal

Once traders have identified a bullish gap-down reversal setup, they can take advantage of this trading opportunity in several ways. One common strategy is to enter a long position as soon as the stock begins to rally and show signs of strength. Traders can set a stop-loss order below the low of the gap-down day to manage risk and protect against a potential reversal.

Another strategy is to wait for a confirmation signal, such as a break above a key resistance level or a strong bullish candlestick pattern, before entering a trade. This approach can help traders filter out false signals and increase the probability of a successful trade.

Managing Risk and Reward

As with any trading strategy, managing risk and reward is crucial when trading bullish gap-down reversals. Traders should always define their risk tolerance and set stop-loss orders to limit potential losses in case the trade does not go as expected. Additionally, it is important to set realistic profit targets based on the price action and market conditions to capture gains and avoid giving back profits.

Traders can also consider using trailing stop-loss orders to lock in profits as the stock continues to move higher. This approach allows traders to ride the trend and maximize their profit potential while managing risk effectively.

In conclusion, bullish gap-down reversals present unique trading opportunities for traders looking to profit from short-term price movements in the financial markets. By accurately identifying this pattern, employing sound trading strategies, and managing risk and reward effectively, traders can enhance their chances of success and capitalize on the bullish momentum. With proper analysis and disciplined execution, traders can harness the power of bullish gap-down reversals to achieve consistent profits in their trading endeavors.