Mastering Your Money: Unleashing the Power of Rules-Based Market Measurement!

In the world of finance, money management is a critical aspect that can significantly impact investment outcomes. As highlighted in the article from GodzillaNewz titled Rules-Based Money Management Part 2: Measuring The Market, having a structured approach to managing money can help investors make informed decisions and navigate the complexities of the market effectively.

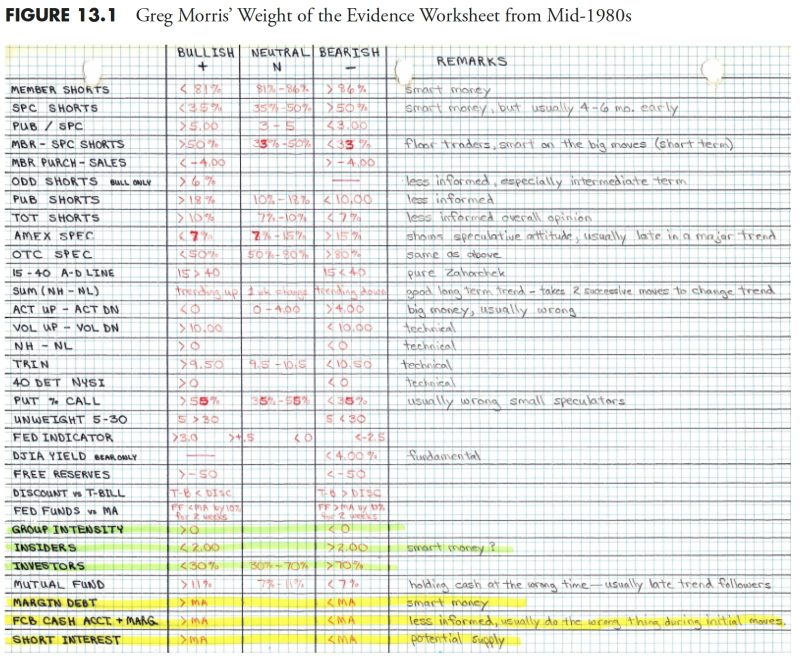

One key concept discussed in the article is the use of market measures to gauge the overall health and direction of the market. Market measures are quantitative indicators that provide insights into the trends and movements within the financial markets. By analyzing these measures, investors can gain a deeper understanding of market dynamics and adjust their investment strategies accordingly.

One commonly used market measure is the advance-decline line, which tracks the number of advancing and declining stocks in the market. This measure can help investors identify the underlying strength or weakness of the market by looking at the breadth of market participation. A strong advance-decline line suggests broad market participation and a healthy market, while a weakening line may indicate underlying weakness and the potential for a market decline.

Another essential market measure discussed in the article is the new high-new low index. This index compares the number of new highs to new lows in a market index, providing insights into market sentiment and potential turning points. High levels of new highs relative to new lows signal a bullish market sentiment, while the opposite may indicate a shift towards bearish sentiment.

Moreover, the concept of relative strength is highlighted as a valuable tool in money management. Relative strength compares the performance of a security or asset to a benchmark index, helping investors identify investments that are outperforming or underperforming the market. By focusing on assets with strong relative strength, investors can potentially enhance their returns and manage risk more effectively.

Risk management is a crucial aspect of money management that is emphasized in the article. Implementing risk management strategies such as setting stop-loss orders and managing position sizes can help investors protect their capital and minimize potential losses. By incorporating risk management principles into their investment process, investors can improve their overall risk-adjusted returns and navigate uncertain market conditions more effectively.

In conclusion, adopting a rules-based approach to money management can provide investors with a structured framework for making informed investment decisions. By leveraging market measures, analyzing relative strength, and implementing effective risk management strategies, investors can enhance their chances of success in the financial markets. As highlighted in the article, understanding and measuring market dynamics are essential components of a comprehensive money management strategy that can help investors achieve their financial goals.