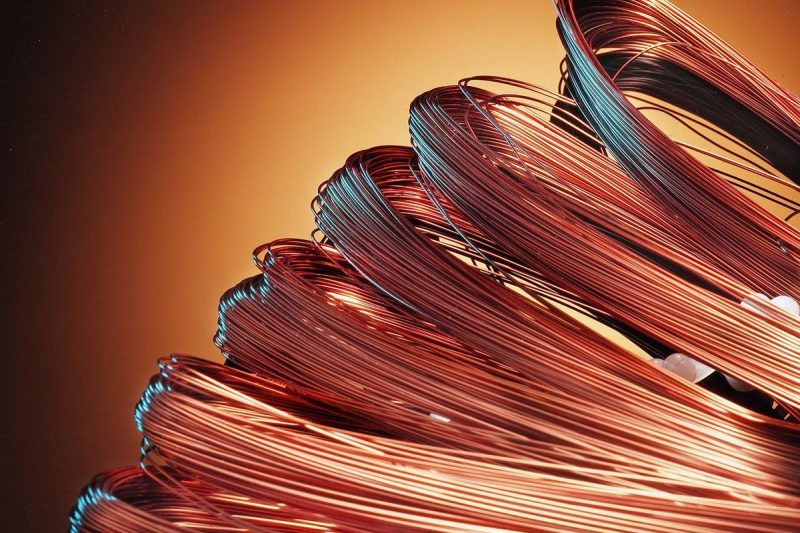

ETFs or exchange-traded funds have gained immense popularity among investors due to their convenience and diversification benefits. Among the various types of ETFs available in the market, Copper ETFs and ETNs have been attracting attention as an alternative investment option. Copper, known as Dr. Copper for its ability to predict economic trends, is a vital industrial metal used in various applications such as construction, electronics, and transportation. In this article, we will explore six Copper ETFs and ETNs that investors can consider for exposure to this essential commodity.

1. **United States Copper Index Fund (CPER):**

CPER is designed to reflect the performance of the SummerHaven Copper Index Total Return, which tracks the price movement of copper futures contracts. This ETF provides investors with a straightforward way to gain exposure to the price of copper without directly investing in physical copper or futures contracts.

2. **Global X Copper Miners ETF (COPX):**

COPX focuses on copper mining companies, providing investors with exposure to the overall performance of global copper miners. By investing in COPX, investors can benefit from the potential growth and profitability of copper mining companies, which are influenced by the price of copper and demand for the metal.

3. **iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC):**

JJC is an exchange-traded note that tracks the Bloomberg Copper Subindex Total Return, providing investors with exposure to the returns of a single unfunded copper futures contract. This ETN offers a way to gain exposure to copper price movements without holding physical copper or investing directly in copper mining companies.

4. **Global X Lithium & Battery Tech ETF (LIT):**

While not solely focused on copper, LIT includes exposure to companies involved in lithium and battery technology, which are key components in electric vehicles and energy storage. Given that copper is a crucial element in electrical conductivity, LIT indirectly provides investors with exposure to the demand for copper in these growing sectors.

5. **iPath Pure Beta Precious Metal ETN (BLNG):**

BLNG is an ETN that offers exposure to a diversified basket of precious metals, including copper, gold, silver, platinum, and palladium. By investing in BLNG, investors can gain exposure to the price movements of multiple precious metals, including copper, which can help diversify their portfolio and mitigate risk.

6. **DB Base Metals Double Long ETN (BDD):**

For investors seeking leveraged exposure to copper and other base metals, BDD offers twice the daily performance of the DBIQ Optimum Yield Industrial Metals Index. This ETN is designed for more aggressive traders looking to capitalize on short-term price movements in the base metals market, including copper.

In conclusion, investing in Copper ETFs and ETNs can be a strategic way for investors to gain exposure to the price movements of copper and related industries. Whether investors are bullish on copper’s prospects as an essential industrial metal or seeking diversification through exposure to base metals, there are several options available to suit their investment objectives and risk tolerance. As with any investment, it is essential for investors to conduct thorough research and consult with a financial advisor before making decisions regarding Copper ETFs and ETNs to ensure alignment with their overall investment strategy.