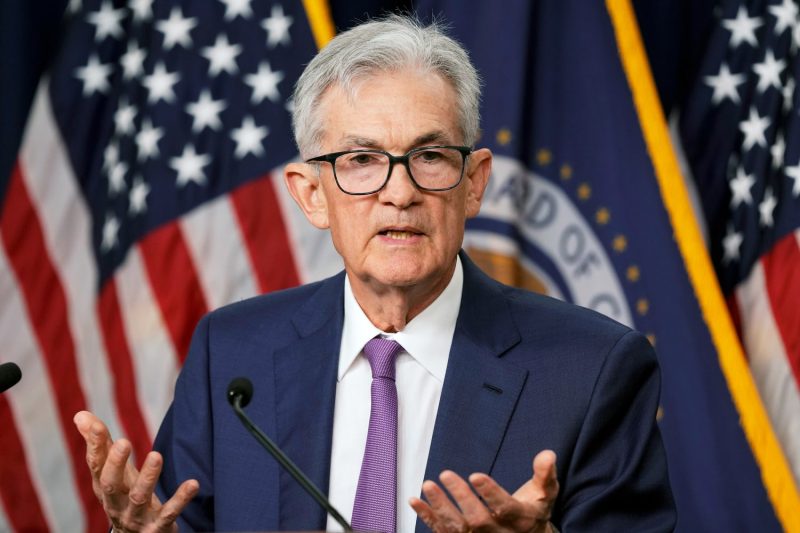

Surprise Inflation Revelation: Fed Chair Powell Foresees Stable Rates Ahead

In a recent update from Federal Reserve Chair Jerome Powell, he revealed that inflation has exceeded expectations and he anticipates interest rates to remain steady. This revelation brings attention to the significance of inflation on the economy and monetary policy decisions. Let’s delve deeper into the implications of higher-than-anticipated inflation rates and the rationale behind keeping interest rates steady.

Firstly, understanding the factors contributing to higher inflation is crucial. Inflation refers to the general increase in prices of goods and services over time, eroding the purchasing power of a currency. Several factors can fuel inflation, such as supply chain disruptions, rising commodity prices, increased consumer demand, and wage pressures. The pandemic-induced disruptions in global supply chains have led to shortages of key inputs, driving up production costs and subsequently retail prices. Moreover, the surge in consumer demand post-lockdowns coupled with supply constraints has further exacerbated inflation levels.

Additionally, Powell’s decision to keep interest rates unchanged reflects the Federal Reserve’s balancing act between controlling inflation and supporting economic growth. Interest rates play a crucial role in shaping borrowing costs, investment decisions, and overall economic activity. By keeping rates steady, the Federal Reserve aims to maintain accommodative financial conditions to support ongoing economic recovery while also closely monitoring inflation trends. Adjusting interest rates too hastily could inadvertently stifle economic growth, while delaying rate hikes may risk allowing inflation to spiral out of control.

Furthermore, Powell’s remarks underscore the Fed’s commitment to its dual mandate of promoting maximum employment and stable prices. Inflation dynamics are closely intertwined with labor market conditions, as wage growth often mirrors inflation trends. While higher inflation can erode real wages, ensuring full employment remains a key objective for policymakers to boost household incomes and sustain consumer spending. By acknowledging the higher-than-expected inflation levels, Powell signals the Fed’s vigilance in monitoring economic data and adjusting policy measures accordingly.

In conclusion, Jerome Powell’s acknowledgment of inflation surpassing estimates and the decision to maintain interest rates at current levels highlight the complexities involved in managing the economy amidst evolving macroeconomic conditions. Navigating through a delicate balance of containing inflationary pressures without impeding economic recovery requires a nuanced approach from policymakers. As the global economy continues to grapple with the aftermath of the pandemic, the Federal Reserve’s cautious stance underscores its commitment to fostering sustainable growth while ensuring price stability.