The article from Godzilla Newz discusses how the market appears to be reaching a potential top, highlighting various indicators and factors contributing to this sentiment. In this response, we will delve deeper into the concept of a toppish market, exploring key signs investors should watch out for, the implications of a market top, and strategies to navigate volatile market conditions.

**Signs of a Market Top**

1. **Overvaluation**: One of the most noticeable signs of a potential market top is when asset prices appear overstretched in comparison to their fundamental value. Metrics like price-to-earnings ratio, price-to-sales ratio, and cyclically adjusted price-to-earnings ratio can provide insights into market valuations.

2. **Rising Interest Rates**: Increasing interest rates by central banks can signal a downside for equities as borrowing costs rise, impacting corporate profitability and consumer spending.

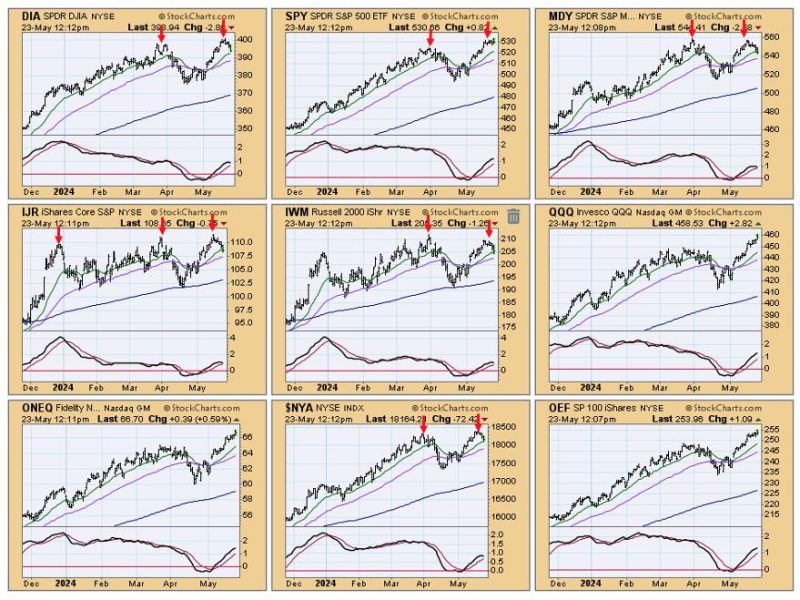

3. **Market Breadth Deterioration**: A narrowing leadership in the market, where only a handful of stocks are driving the indices higher while the majority of stocks are underperforming, can indicate a weakening market foundation.

4. **Bearish Divergences**: When key indices like the S&P 500 or Dow Jones Industrial Average are making new highs but technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) show weakening momentum, it could signal a potential reversal.

**Implications of a Market Top**

1. **Correction or Bear Market**: A market top often precedes a correction (a decline of 10-20% from recent peak) or a bear market (a decline of 20% or more). Investors should be prepared for heightened volatility and potential losses in their investment portfolios.

2. **Opportunities Amidst Challenges**: While a market top can be daunting, it also presents opportunities for savvy investors. By adopting risk management strategies, diversifying portfolios, and staying informed about market trends, investors can navigate turbulent times effectively.

3. **Reassessment of Investment Strategy**: An impending market top prompts investors to reassess their investment goals, risk tolerance, and asset allocation. It may be a suitable time to rebalance portfolios, trim overvalued assets, and seek exposure to defensive sectors.

**Strategies to Navigate a Topping Market**

1. **Diversification**: Diversifying across asset classes, geographies, and sectors can help mitigate risks associated with a market top. Allocating to non-correlated assets such as bonds, gold, or real estate can provide a cushion during market downturns.

2. **Risk Management**: Implementing stop-loss orders, setting a target allocation, and having a clear exit strategy in place can help protect investment gains and limit potential losses during turbulent market conditions.

3. **Selective Investing**: In a topping market, being selective with stock picks and focusing on companies with strong fundamentals, competitive advantages, and attractive valuations can enhance long-term investment outcomes.

In conclusion, identifying a market top and understanding its implications are crucial for investors to make informed decisions and safeguard their portfolios. By recognizing key signs, preparing for potential challenges, and adopting prudent strategies, investors can navigate through volatile market environments with resilience and confidence.