Equities in Full Gear: Tech and Utilities Leaders are Few and Far Between

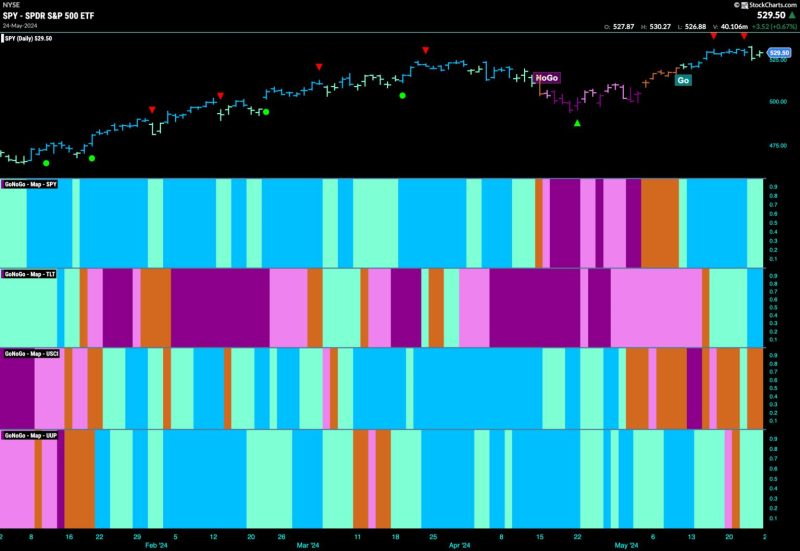

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The ongoing trend in the equities market continues to be positive, with an overall bullish sentiment prevailing among investors. This positive outlook is reflected in the performance of various sectors, where some are demonstrating strong leadership while others are lagging behind. In particular, the technology and utilities sectors have shown sparse leadership, with other sectors taking the lead in driving market performance.

One of the standout sectors in driving the current go trend in equities is the healthcare sector. Healthcare stocks have been performing well, buoyed by factors such as strong earnings growth, innovative advancements in medical technology, and the increased focus on healthcare services and products. Investors have shown confidence in the healthcare sector, as it continues to offer promising investment opportunities amidst a dynamic market environment.

Another sector that has been at the forefront of the go trend in equities is the consumer discretionary sector. Companies in this sector have benefited from increased consumer spending, driven by a strong economy and rising consumer confidence. Retailers, entertainment companies, and leisure businesses have capitalized on this trend, demonstrating solid growth and contributing positively to the overall market performance.

Additionally, the financial sector has also played a significant role in driving the positive momentum in equities. Banks and financial institutions have benefited from a supportive regulatory environment, improving economic conditions, and rising interest rates. These factors have boosted the profitability and growth prospects of financial companies, attracting investors looking for opportunities in a sector poised for further expansion.

While some sectors have been leading the way in the current go trend, the technology and utilities sectors have shown sparse leadership in comparison. Technology stocks, which have traditionally been a powerhouse in the equity market, have faced challenges such as regulatory scrutiny, trade tensions, and concerns about valuation levels. These factors have contributed to a more subdued performance by technology companies, limiting their impact on the overall market direction.

Similarly, the utilities sector has not been a prominent driver of the go trend in equities. Utilities are typically considered defensive stocks, favored by investors during times of economic uncertainty or market volatility. However, the current market environment, characterized by optimism and risk appetite, has relegated utilities to a less influential position in driving overall market performance.

In conclusion, the equities market remains in a go trend, with certain sectors exhibiting strong leadership while others lag behind. The healthcare, consumer discretionary, and financial sectors have been key drivers of the positive momentum in equities, benefitting from favorable market conditions and investors’ confidence. Meanwhile, the technology and utilities sectors have shown sparse leadership, facing challenges that have limited their impact on the broader market direction. As investors navigate the dynamic landscape of equities, understanding sector-specific dynamics and trends will be crucial in identifying opportunities and making informed investment decisions.