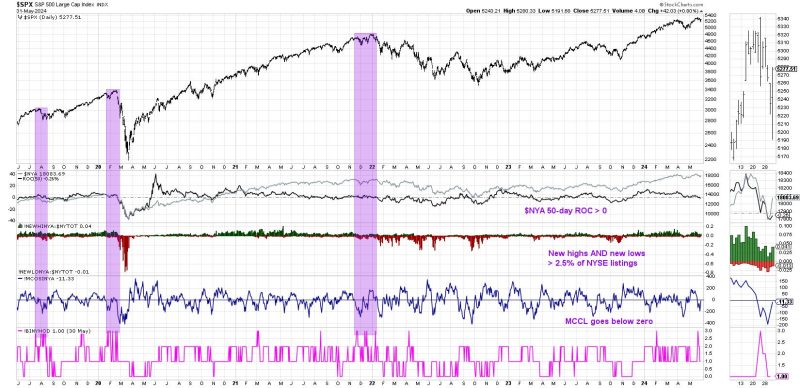

The recent Hindenburg Omen signal has sparked concerns among investors about a potential market downturn. The Hindenburg Omen is a technical analysis pattern that signals a potential stock market crash. It occurs when a series of specific market conditions align, including a high number of new 52-week highs and lows, an advancing-declining stock ratio, and increased volatility.

In recent weeks, the Hindenburg Omen has been flashing an initial sell signal, causing market analysts and investors to take notice. This signal has historically been associated with increased market volatility and the potential for a significant downturn in stock prices.

While the Hindenburg Omen is not a foolproof indicator of a market crash, its occurrence should not be taken lightly. Investors may choose to proceed with caution, closely monitoring their investments and considering risk management strategies in the face of increased market uncertainty.

Market analysts and experts are divided on the significance of the Hindenburg Omen signal. Some view it as a valuable warning sign that should not be ignored, while others caution against relying too heavily on technical indicators alone. It is essential for investors to consider a variety of factors when making investment decisions, including fundamental analysis, market trends, and risk tolerance.

In conclusion, the recent Hindenburg Omen signal flashing an initial sell warning has raised concerns about a potential stock market downturn. While its significance may vary among market participants, investors should pay attention to this technical indicator and consider adjusting their investment strategies accordingly. As always, it is essential to conduct thorough research and seek professional advice before making any significant investment decisions in uncertain market conditions.