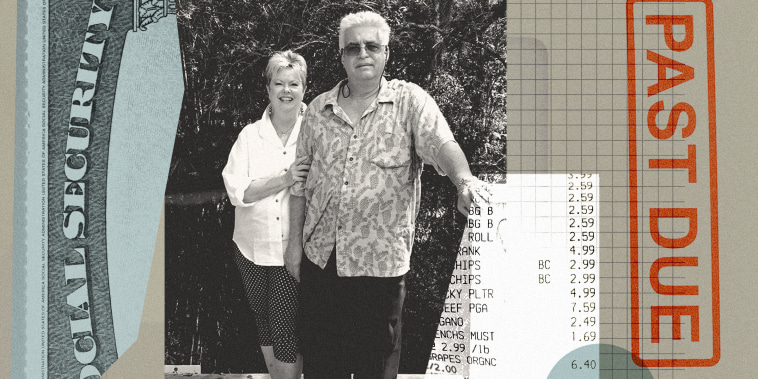

Florida Retiree Struggles to Make Ends Meet on $2,400 Monthly Income

In a society where retirement is often seen as a time of leisure and enjoyment after years of hard work, the reality can be starkly different for many individuals. One such case is that of a retiree living in Florida who, despite dreams of golden years filled with relaxation and happiness, finds herself struggling to make ends meet on a modest income of $2400 a month.

The retiree’s story is a stark reminder of the financial challenges faced by a growing number of seniors in the United States. With savings drained and limited income, she is forced to juggle expenses and make tough decisions on a daily basis. The retiree’s situation sheds light on the harsh reality that many older adults face, where financial insecurity can overshadow what should be a time of peace and fulfillment.

One of the primary issues highlighted in this case is the impact of rising costs of living on retirees. From housing and healthcare to everyday expenses like groceries and utilities, the retiree is finding it increasingly difficult to keep up with the escalating prices. Despite careful budgeting and frugal living, she is forced to make sacrifices and cut back on essentials to make ends meet.

Healthcare costs, in particular, pose a significant burden for the retiree, consuming a large portion of her monthly income. With medical expenses on the rise and limited access to affordable healthcare options, she is left with little choice but to forego certain treatments or medications, putting her health at risk in the process.

Furthermore, the retiree’s experience highlights the importance of adequate retirement planning and savings. As life expectancies increase and pension plans become less common, individuals are increasingly responsible for financing their own retirement. Without a solid financial cushion to rely on, many retirees are left vulnerable to financial instability and hardship in their later years.

Another key aspect of the retiree’s situation is the emotional toll of financial strain. Living on a fixed income and constantly worrying about money can take a significant toll on mental health and well-being. The retiree’s dreams of a comfortable retirement have been overshadowed by stress and anxiety, as she navigates the daily challenges of making her limited income stretch.

In conclusion, the story of this Florida retiree serves as a poignant reminder of the financial realities faced by many older adults in the United States. With savings depleted and limited resources, she is forced to navigate a difficult path in her golden years. As a society, we must work towards creating a more secure and sustainable future for our aging population, ensuring that all individuals have the opportunity to enjoy a dignified and stable retirement.