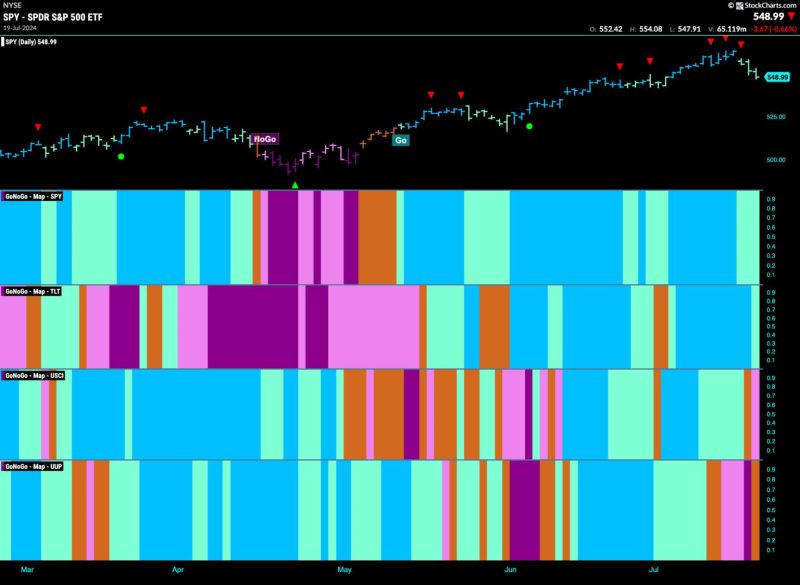

Financials Begin to Outperform as Equity Go Trend Weakens

The global economic landscape has been showing signs of significant shifts in recent months, particularly in the performance of financial markets. Amid a slowdown in equity markets worldwide, financials have begun to outperform, indicating a potential shift in investor sentiment and preferences.

As the equity market rally that characterized the past year starts to lose steam, investors are seeking opportunities in other asset classes. Financial stocks, in particular, have been attracting increased interest from market participants. This shift can be attributed to various factors, including changing economic conditions, evolving market dynamics, and sector-specific developments.

One key driver behind the outperformance of financials is the expectation of rising interest rates. With central banks signaling a move towards tightening monetary policy to combat inflationary pressures, the prospect of higher interest rates has boosted the profitability outlook for financial institutions. Banks, in particular, stand to benefit from a steeper yield curve, which can improve their net interest margins and overall financial performance.

Moreover, financial companies have been actively leveraging technology and digital transformation to enhance their operational efficiency and customer experience. Fintech innovation has been reshaping the industry, leading to the emergence of new business models and revenue streams. As a result, financial firms that have embraced technology and adapted to changing consumer preferences are well-positioned to capitalize on the evolving landscape.

Another factor contributing to the outperformance of financials is the shift towards value investing. As growth stocks, which fueled the equity market rally in recent years, face challenges amid concerns over high valuations and regulatory scrutiny, value-oriented sectors such as financials have become more attractive to investors seeking undervalued opportunities. This trend highlights a broader rotation in investor preferences towards more defensive and fundamentally sound assets.

Despite the positive outlook for financial stocks, it is essential for investors to exercise caution and conduct thorough research before making investment decisions. The market remains volatile, and uncertainties persist, requiring a prudent approach to portfolio management. Diversification across asset classes and sectors can help mitigate risk and enhance long-term returns in a dynamic market environment.

In conclusion, the recent outperformance of financials amid a weakening equity market trend underscores the importance of monitoring market dynamics and adapting investment strategies accordingly. As economic conditions continue to evolve, staying informed and being prepared to adjust portfolio allocations can help investors navigate changing market environments and capitalize on emerging opportunities.