Navigating Market Turbulence: Unveiling the Breadth Indicator’s Signal for Profitable Opportunities

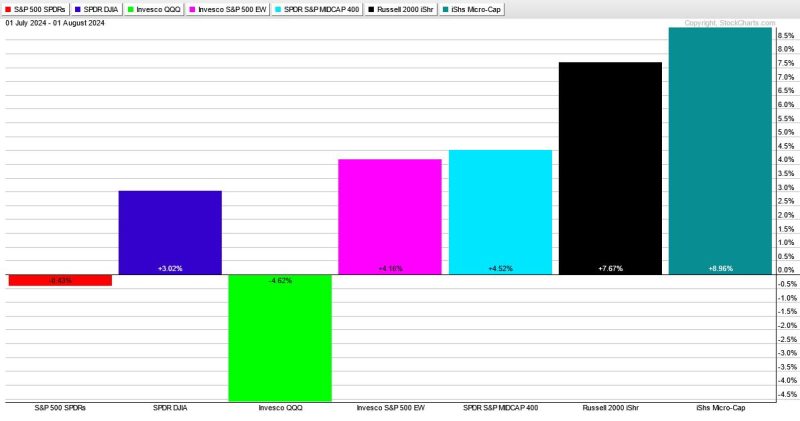

The breadth indicator discussed in the article suggests that there may be more downside ahead for the market, but also potentially presents an opportunity for investors. This indicator measures the number of stocks participating in a market move, helping to assess the market’s overall strength. A strong indicator would show that there is broad participation and support for a market move, while a weak indicator could signal that only a limited number of stocks are driving the movement, making it less sustainable.

Currently, this breadth indicator is pointing towards more downside in the market. This could mean that the recent market rally was driven by a narrow group of stocks, rather than being supported by a broad base of companies. Such a scenario could lead to increased volatility and potentially further declines in the market.

However, it’s important for investors to not view this indicator solely as a negative sign. In fact, a market correction can create buying opportunities for investors who are looking to enter the market or add to their positions in quality companies at more attractive valuations. A downturn in the market can provide a chance to invest in solid companies that may have been overvalued during a bull market.

For investors, it’s essential to stay informed about such market indicators and use them as one of the tools in their investment decision-making process. While a breadth indicator pointing towards downside may warrant caution, it doesn’t mean that all investments should be abandoned. Rather, it could be a time to reassess one’s portfolio, diversify holdings, and look for quality companies that are trading at discounts.

In conclusion, while the current breadth indicator may indicate more downside in the market, it also presents an opportunity for investors to capitalize on potential buying opportunities. By remaining vigilant, conducting thorough research, and staying disciplined in their investment approach, investors can navigate market fluctuations and take advantage of investment prospects that arise during periods of uncertainty.