Shocking Revelation: The Fed’s Nightmare Creation – Are We Just Puppets?

The Federal Reserve: Balancing Act or Nightmare Creator?

The Federal Reserve, often referred to as the Fed, holds considerable influence over the United States’ economy. While its primary objective is to promote economic growth and stability through its monetary policies, recent events have raised concerns about the unintended consequences of its actions. Critics argue that the Fed may be inadvertently creating a financial nightmare, with the public and economy at its mercy.

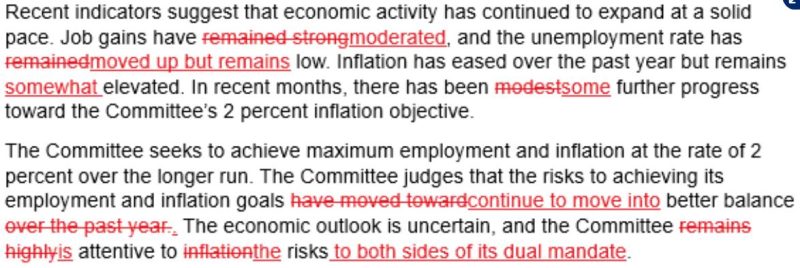

One of the key tools at the Fed’s disposal is its ability to set interest rates. By raising or lowering interest rates, the Fed can influence borrowing costs, inflation, and overall economic activity. However, the Fed’s recent decisions regarding interest rates have sparked controversy and debate. Critics argue that the Fed’s aggressive rate cuts during economic downturns may be exacerbating inequality and distorting market signals.

Furthermore, the Fed’s massive bond-buying programs, known as quantitative easing, have raised concerns about the long-term effects on asset prices and market stability. While these programs were initially implemented to stimulate the economy during times of crisis, they have become a more frequent tool in the Fed’s arsenal. Critics worry that these actions may be inflating asset bubbles and creating a false sense of security in the financial markets.

Another point of contention is the Fed’s independence and accountability. While the Fed operates autonomously from the government, its decisions have far-reaching implications for the economy and society as a whole. The lack of transparency and accountability in the Fed’s decision-making process has led some to question the Fed’s motives and effectiveness.

Moreover, the Fed’s role as the lender of last resort has come under scrutiny in recent years. Critics argue that the Fed’s actions to bail out financial institutions during times of crisis may be perpetuating a moral hazard by encouraging excessive risk-taking. This, in turn, could lead to further financial instability in the future.

In conclusion, while the Fed plays a crucial role in managing the U.S. economy, its actions and policies are not without their drawbacks. The Fed must strike a delicate balance between promoting economic growth and stability while avoiding unintended consequences that may harm the economy in the long run. By addressing these concerns and fostering greater transparency and accountability, the Fed can better serve the interests of the public and ensure a more stable and prosperous future for all.