Market Sentiment Indicators: An Essential Tool for Investors

Market sentiment plays a crucial role in determining the direction of stock prices. Investors use various indicators to gauge market sentiment and make informed decisions. In this article, we will explore three key market sentiment indicators that confirm a bearish phase in the market.

1. Put/Call Ratio

The Put/Call Ratio is a widely used indicator to measure market sentiment. It compares the number of put options (bearish bets) to call options (bullish bets) in the market. A high Put/Call Ratio indicates a bearish sentiment, suggesting that investors are pessimistic about the market’s future. Conversely, a low ratio may signal bullish sentiment.

In the current market environment, a rising Put/Call Ratio is indicating increasing fear and uncertainty among investors. This could be attributed to factors such as geopolitical tensions, inflation concerns, or disappointing earnings reports. As a result, the bearish phase in the market is likely to persist until sentiment improves.

2. Volatility Index (VIX)

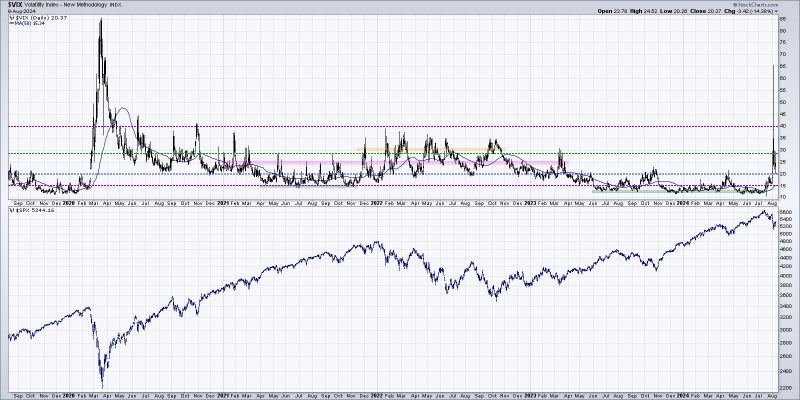

The Volatility Index, also known as the VIX or fear index, measures market volatility and investor fear. When the VIX is high, it indicates that investors are anticipating higher volatility and potential downside risk in the market. Conversely, a low VIX suggests lower volatility and a more complacent market sentiment.

Recent spikes in the VIX suggest that market participants are becoming more risk-averse and anticipating increased market fluctuations. This heightened volatility is often associated with bearish market phases, as investors seek to protect their portfolios from potential losses.

3. Investor Sentiment Surveys

Investor sentiment surveys are another valuable tool for measuring market sentiment. These surveys gauge the opinions and attitudes of individual investors, institutional investors, and market analysts towards the market. Bullish sentiment often peaks at market tops, while bearish sentiment tends to prevail during market bottoms.

Recent investor sentiment surveys have shown a growing pessimism towards the market outlook. Many investors are concerned about rising interest rates, inflationary pressures, and global economic uncertainties. This negative sentiment is reinforcing the bearish phase in the market, as investors adopt a cautious approach and reduce their exposure to risk assets.

In conclusion, market sentiment indicators play a vital role in guiding investors through volatile market conditions. The Put/Call Ratio, Volatility Index, and investor sentiment surveys provide valuable insights into market sentiment and help investors navigate changing market dynamics. By paying attention to these indicators, investors can make informed decisions and position their portfolios accordingly in bearish market phases.