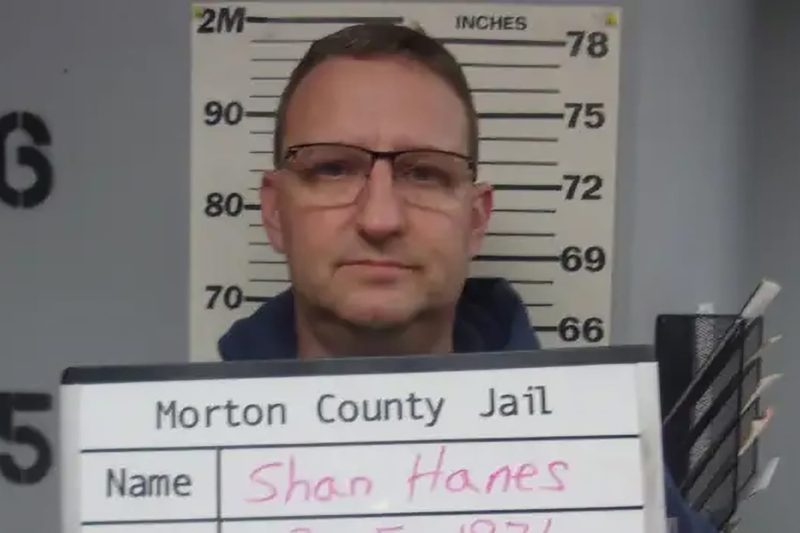

Kansas Bank Crushed by ‘Pig Butchering’ Cryptocurrency Scam: Ex-CEO Jailed for 24 Years

In a bizarre and audacious scheme that left a Kansas bank in ruins and its former CEO sentenced to a staggering 24 years in prison, a diabolical cryptocurrency pig butchering scam has shocked the financial world and raised concerns about the vulnerabilities of the ever-evolving digital currency landscape.

The elaborate web of deception began innocuously enough, with the former CEO of First Heartland Bank, Scott Bishop, allegedly lured into a high-stakes cryptocurrency investment opportunity promising astronomical returns. Operating under the guise of a legitimate Swiss-based investment firm specializing in unique blockchain solutions, Bishop was initially captivated by the prospect of diversifying the bank’s portfolio and staying ahead of the financial curve.

However, what initially seemed like a golden opportunity quickly spiraled into a nightmarish saga of deceit and financial ruin. The so-called cryptocurrency pig butchering scam, a cleverly disguised Ponzi scheme, involved enticing investors with promises of revolutionary blockchain technology that would transform the pork industry. The concept was simple yet alluring – investors would contribute their funds to support the development of a blockchain platform that would purportedly streamline the pig butchering process, leading to significant cost savings for the industry.

As the scheme unfolded, Bishop and his accomplices went to great lengths to fabricate the illusion of success, using falsified financial reports and forged partnerships to maintain the confidence of investors. The promise of quick profits and the allure of cutting-edge technology proved to be a potent combination, drawing in a steady stream of unsuspecting victims who were eager to cash in on the cryptocurrency craze.

However, the house of cards eventually came crashing down, revealing the elaborate scam that had been meticulously constructed to defraud investors. The purported blockchain platform for pig butchering was nothing more than a mirage, and the funds invested by individuals and institutions alike had vanished into thin air.

In the aftermath of the scandal, the once-respected CEO found himself at the center of a legal maelstrom, facing a litany of charges related to fraud, money laundering, and conspiracy. The court proceedings that followed painted a grim picture of greed and deception, as Bishop and his co-conspirators were held to account for perpetrating one of the most audacious financial frauds in recent memory.

The fallout from the cryptocurrency pig butchering scam reverberated throughout the banking industry, sparking renewed scrutiny of the risks associated with digital currencies and highlighting the need for enhanced regulatory oversight. The case served as a stark reminder of the dangers posed by unscrupulous actors who exploit the complexities of the cryptocurrency market for personal gain, leaving a trail of destruction in their wake.

As investors and financial institutions grapple with the fallout from this unprecedented scandal, one thing remains clear – vigilance and due diligence are paramount when navigating the treacherous waters of the cryptocurrency landscape. The lessons learned from the cryptocurrency pig butchering scam serve as a cautionary tale for those who seek to harness the potential of digital currencies while avoiding the pitfalls of fraud and deception.