Navigating the Week: NIFTY’s Upward Trajectory at Risk – Stay Wary

The Week Ahead: Nifty Shows Early Signs of a Likely Disruption of Uptrend – Tread Cautiously

The stock market is a dynamic organism, constantly shifting and evolving with the ebb and flow of economic patterns and global events. In recent times, the Nifty index has been on an upward trajectory, mirroring the overall positive sentiment in the market. However, as we move into the new week, there are early indications that this uptrend may be at risk of disruption, prompting investors to exercise caution in their trading decisions.

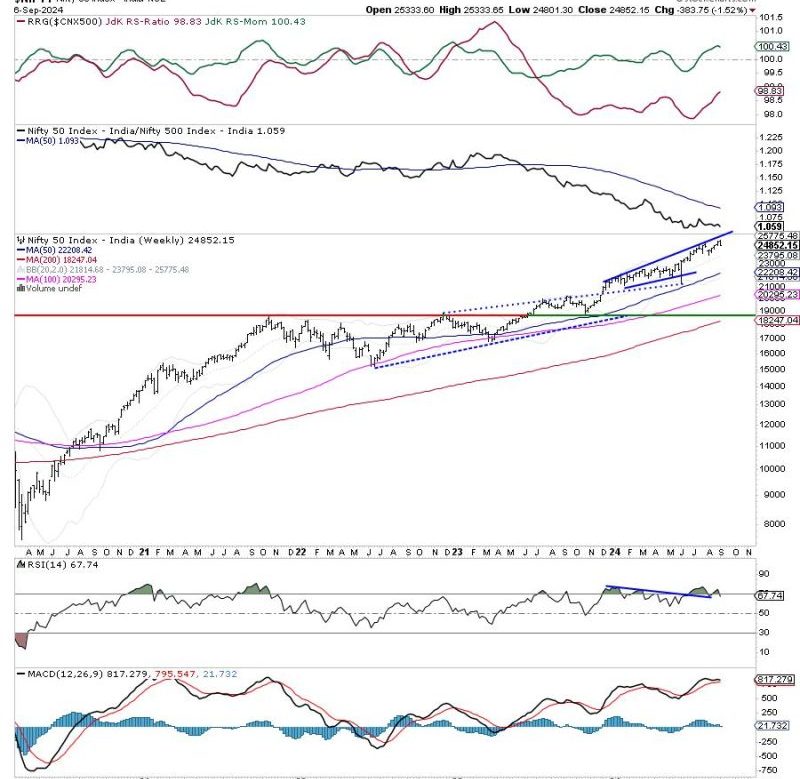

One of the key signals that suggest a potential disruption in the uptrend is the emergence of bearish divergence patterns in the Nifty index. Bearish divergence occurs when the price of an asset continues to rise, but the momentum indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), show a weakening trend. This indicates that the buying pressure supporting the upward movement may be waning, potentially paving the way for a reversal in trend.

Another factor contributing to the cautious outlook for the Nifty index is the looming uncertainties in the global market environment. Geopolitical tensions, fluctuating commodity prices, and the ongoing impact of the COVID-19 pandemic are all variables that could influence market sentiment and trigger a shift in investor behavior. As a result, traders are advised to closely monitor these external factors and adjust their strategies accordingly to mitigate potential risks.

In addition to the external factors, the technical analysis of the Nifty index also provides valuable insights into the market outlook for the upcoming week. Key support and resistance levels, trendlines, and chart patterns can offer valuable cues to investors about the likely direction of the market. By paying attention to these technical indicators and conducting thorough analysis, traders can make informed decisions and navigate the market volatility with greater confidence.

Furthermore, maintaining a diversified portfolio and implementing risk management strategies are essential components of a successful trading approach, especially in times of uncertainty and potential market disruptions. By spreading investments across different asset classes and sectors, investors can reduce their exposure to any single risk factor and improve the resilience of their portfolio in the face of market turbulence.

As we brace for the week ahead, it is imperative for investors to remain vigilant, stay informed about the latest market developments, and adapt their trading strategies to the prevailing conditions. While the Nifty index may be showing early signs of a possible disruption in the uptrend, by exercising prudence and implementing sound risk management practices, traders can position themselves to navigate the challenges and opportunities that lie ahead in the dynamic stock market landscape.