Equities Say Go Fish: How Healthy Are the Markets?

The financial markets have always been subject to fluctuations and uncertainties. Investors, analysts, and economists closely monitor various indicators and metrics to gauge the health and stability of the markets. Equities, also known as stocks, play a crucial role in determining the overall health of the financial markets.

Equities are ownership shares in a company, representing ownership stake in the company. The performance of equities is often used as a barometer for the broader market sentiment and economic health. When equities are performing well, it is generally seen as a positive sign for the economy, indicating investor confidence and optimism about future growth prospects.

However, the health of equities and, by extension, the financial markets, is influenced by a myriad of factors. These factors can range from macroeconomic trends and geopolitical developments to company-specific news and regulatory changes. Understanding and analyzing these factors is essential for investors to make informed decisions and manage risks effectively.

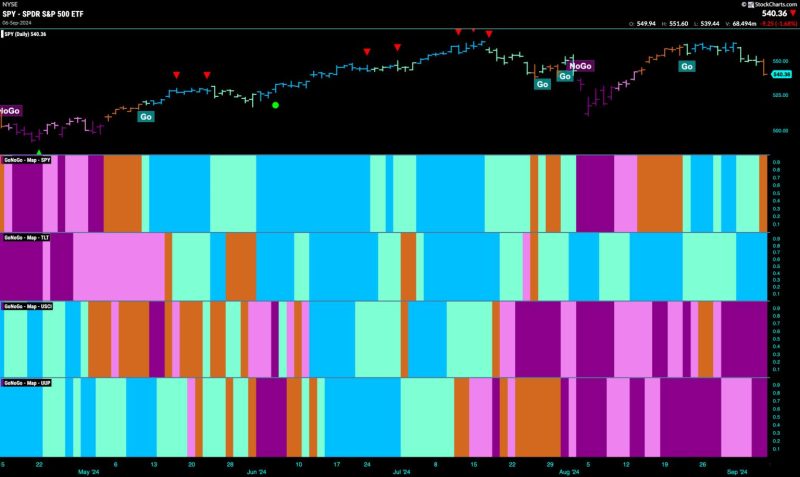

One key indicator that investors often look at is the stock market indices, such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite Index. These indices track the performance of a basket of stocks and are often considered benchmarks for the broader market. A rising index is typically interpreted as a bullish signal, indicating that the market is on an upward trend, while a declining index may suggest a bearish sentiment.

In addition to stock market indices, investors also pay attention to valuation metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. These metrics provide insights into the relative valuation of stocks and can help investors assess whether stocks are overvalued or undervalued. High valuations may indicate frothiness in the market, while low valuations may present buying opportunities.

Another factor that influences the health of equities is corporate earnings. Earnings reports, released quarterly by publicly traded companies, provide valuable information about the financial performance and prospects of companies. Strong earnings growth is often seen as a positive sign for stocks, as it indicates that companies are profitable and growing. Conversely, weak earnings may lead to a decline in stock prices.

Apart from earnings, investors also consider factors such as interest rates, inflation, and economic indicators like GDP growth, unemployment rate, and consumer sentiment. Changes in these macroeconomic variables can impact investor sentiment and market dynamics, influencing the performance of equities.

Furthermore, geopolitical events, such as trade tensions, political instability, and global health crises, can create uncertainty in the markets and lead to volatility in equities. Investors need to stay informed about these events and assess their potential impact on the markets to make well-informed investment decisions.

In conclusion, equities play a vital role in determining the health and stability of the financial markets. By monitoring key indicators, such as stock market indices, valuation metrics, corporate earnings, and macroeconomic factors, investors can gain valuable insights into market trends and make informed investment decisions. However, it is essential to remember that the markets are inherently unpredictable, and risks are inherent in investing. Conducting thorough research, diversifying portfolios, and seeking professional advice can help investors navigate the complex and dynamic world of equities effectively.