The article discusses the intriguing case of a déjà vu in the consumer staples sector that has sent a strong warning signal to investors. Drawing parallels between past market events and the current situation, it seeks to shed light on potential implications for the sector and beyond.

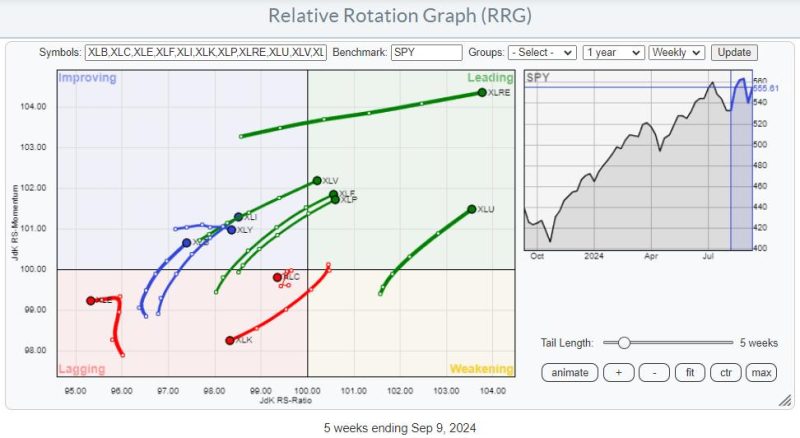

The article begins by highlighting the familiar pattern that has emerged in the consumer staples sector, reminiscent of a similar sequence of events witnessed in the past. This pattern serves as a striking reminder of historical market behavior and prompts a deeper analysis of the situation at hand.

By delving into the specific trends and factors driving this déjà vu moment, the article uncovers key insights into the dynamics at play within the consumer staples sector. From shifts in consumer preferences to evolving market conditions, a confluence of factors is shaping the current landscape and influencing investor sentiment.

Furthermore, the article explores the broader implications of this warning signal for the consumer staples sector as well as the wider market. By drawing parallels with past market downturns and their ripple effects, it paints a vivid picture of the potential challenges and opportunities that lie ahead.

In light of this déjà vu moment, the article also discusses strategies that investors can consider to navigate the uncertain terrain. From diversifying portfolios to staying vigilant and adaptable in the face of changing market dynamics, there are various approaches that can help mitigate risks and capture potential opportunities.

Ultimately, the article serves as a timely reminder for investors to heed the warning signals emanating from the consumer staples sector. By paying attention to historical patterns and market trends, stakeholders can better position themselves to weather potential storms and capitalize on emerging opportunities in an increasingly complex and interconnected global economy.