Bulls vs. Bears: Unveiling the Impact of Rate Cuts on Stock Performance

After analyzing historical data and trends, it is evident that the effect of rate cuts on stock performance is a topic of significant interest and debate among investors. The question of whether rate cuts are bullish or bearish for stock market returns has divided experts and analysts, with varying viewpoints on the matter.

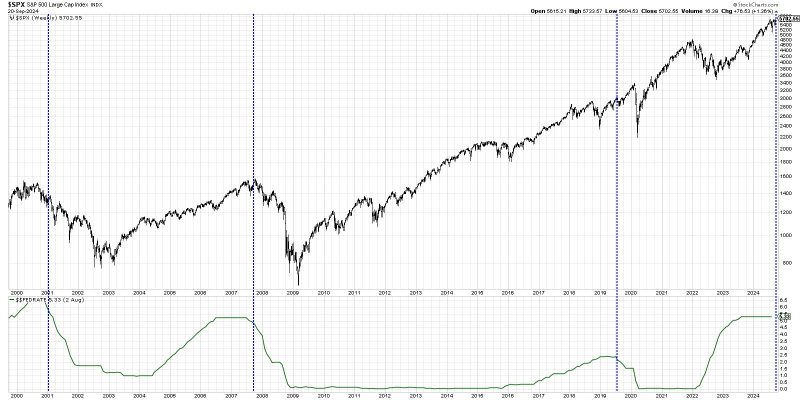

The Federal Reserve’s decision to lower interest rates typically signals an attempt to stimulate economic growth by making borrowing cheaper. Lower interest rates can lead to increased consumer spending, corporate investment, and overall economic activity, which, in turn, may benefit stock prices. This perspective suggests a bullish outlook for stocks following a rate cut.

However, the relationship between rate cuts and stock performance is more complex and nuanced than a straightforward cause-and-effect scenario. The stock market’s reaction to rate cuts is influenced by a variety of factors, including the overall economic environment, market expectations, and investor sentiment.

It is important to note that the impact of rate cuts on stock returns may vary depending on the timing and magnitude of the rate cut, as well as the underlying reasons for the policy change. Market participants closely monitor the Federal Reserve’s communications and statements for insights into future rate decisions, which can influence stock prices in the short term.

Moreover, while rate cuts may initially boost stock prices, they can also raise concerns about the state of the economy and future earnings growth. Investors may interpret rate cuts as a signal of weakening economic conditions, which could lead to increased market volatility and uncertainty.

In addition, the efficacy of rate cuts in supporting stock market performance may diminish over time, especially in prolonged periods of low interest rates. Continued rate cuts may have diminishing returns on economic growth and market returns, as the stimulative effects of lower rates become less potent.

Overall, the relationship between rate cuts and stock performance is multifaceted and subject to various interpretations. While rate cuts can provide a temporary boost to stock prices by spurring economic activity, they may also reflect underlying economic concerns that could weigh on market sentiment in the long run.

Investors should consider a holistic approach to analyzing the impact of rate cuts on stock performance, taking into account broader economic indicators, market dynamics, and risk factors. By staying informed and maintaining a diversified investment portfolio, investors can navigate the complexities of rate cuts and make well-informed decisions to achieve their financial goals.