Powering Up: Equities Ride the ‘Go’ Trend with Utilities on the Rise

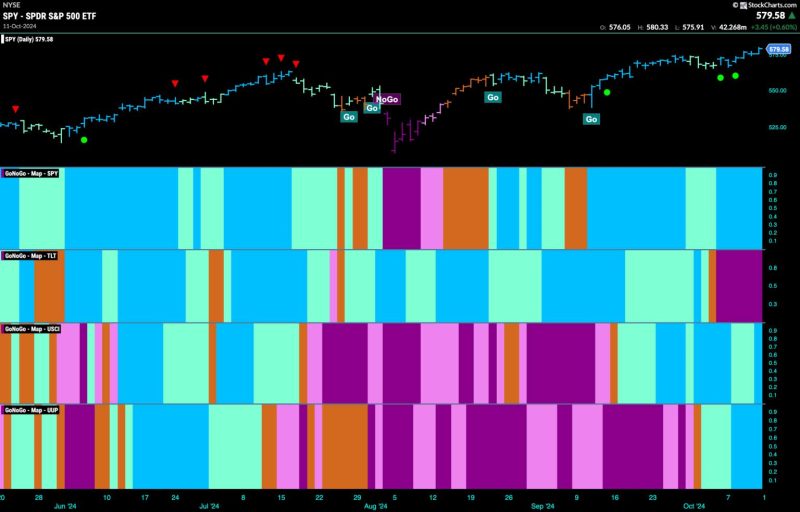

Equities Remain in Go Trend as We See Rotation into Utilities

The stock market continues to display strength as equities remain in a Go trend, with investors rotating into defensive sectors such as utilities. This industry shift reflects a sense of caution among investors as they position themselves for potential market volatility and economic uncertainties.

The ongoing trend in equities indicates a positive outlook overall, as investors remain optimistic about the prospects for economic growth and corporate earnings. With the U.S. economy showing signs of recovery and inflation worries receding, investors are more inclined to maintain exposure to equities and take advantage of potential gains in the stock market.

The rotation into utilities is particularly noteworthy, as these companies offer stable revenues and dividends, making them an attractive option for investors seeking safety and income. Utilities are also considered a defensive sector, typically outperforming in times of market downturns or economic uncertainty. As such, the movement of funds into this sector indicates a growing appetite for defensive positioning among investors.

While the broader equities market remains strong, it is crucial for investors to remain vigilant and monitor market conditions closely. Economic indicators, corporate earnings reports, and geopolitical events can all influence market sentiment and direction. Staying informed and being prepared to adjust investment strategies accordingly are key to navigating the shifting landscape of the stock market.

In conclusion, the current trend in equities indicates a positive outlook with investors continuing to position themselves in the stock market, while also showing a preference for defensive sectors like utilities. By staying aware of market developments and being proactive in managing investment portfolios, investors can better navigate market fluctuations and capitalize on investment opportunities in the ever-evolving landscape of the stock market.