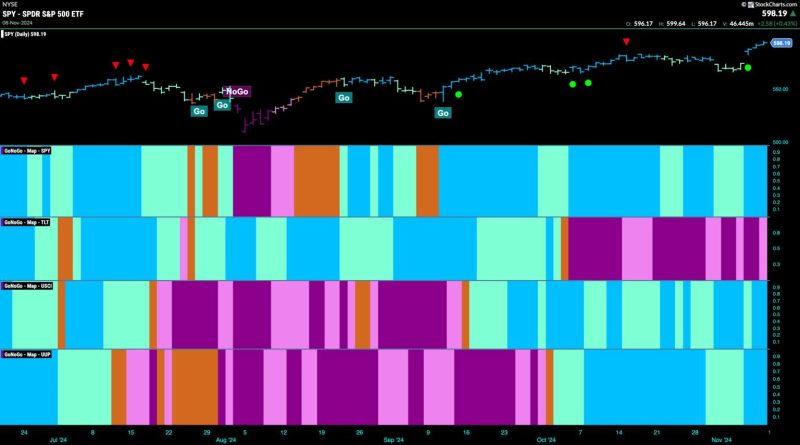

Riding the Equity Go Wave: Surge in Strength Propelled by Soaring Financials

Equity Go-Trend Sees Surge in Strength as Financials Drive Price Higher

The Equity Go-Trend has experienced a notable surge in strength as financials take the lead in driving prices higher. This upward momentum is largely attributed to several key factors, including favorable market conditions, robust financial performance, and growing investor confidence.

One of the primary drivers behind the surge in equity prices is the strong performance of the financial sector. Financial institutions have been reporting solid earnings and growth figures, which have helped boost investor sentiment and drive demand for financial stocks. This trend is further supported by the overall stability in the financial markets, with many institutions maintaining healthy balance sheets and capital reserves.

Additionally, the Equity Go-Trend has been bolstered by favorable market conditions, including low interest rates and strong economic growth. As central banks around the world continue to maintain accommodative monetary policies, investors are finding it more attractive to invest in equities as a means to achieve higher returns compared to traditional fixed income securities.

Moreover, the growing confidence among investors in the equity markets has also contributed to the surge in strength of the Equity Go-Trend. As global economies recover from the impacts of the pandemic and businesses adapt to the new normal, investors are increasingly optimistic about the future prospects of equities and are willing to take on higher levels of risk to capitalize on potential returns.

In conclusion, the recent surge in strength of the Equity Go-Trend can be largely attributed to the strong performance of the financial sector, favorable market conditions, and growing investor confidence. As the trend continues to evolve, it will be essential for investors to remain vigilant and stay informed about market developments to make informed investment decisions that align with their financial goals and risk tolerance levels.