The recent fluctuations in the value of the US dollar have sparked debates among economists and investors about the potential for a significant rally. The USD’s performance in the coming months will not only impact the American economy but also have global implications. In this article, we will delve into the factors that could influence the US dollar’s direction and analyze whether it is indeed setting up for a perfect rally.

1. **Federal Reserve Policies**: The policies implemented by the Federal Reserve play a crucial role in determining the strength of the US dollar. The central bank’s decisions on interest rates and quantitative easing measures can significantly impact the currency’s value. If the Fed continues with a hawkish stance, raising interest rates to combat inflationary pressures, it could bolster the USD’s attractiveness to investors seeking higher yields, leading to a potential rally.

2. **Global Economic Conditions**: The USD’s value is also influenced by global economic conditions. A strong US economy relative to its trading partners can attract foreign capital, boosting the demand for the currency. On the other hand, geopolitical tensions or economic crises in key regions could lead to a flight to safety, benefitting the US dollar. Monitoring international developments and their impact on the broader economic landscape is essential for gauging the USD’s trajectory.

3. **Market Sentiment and Risk Appetite**: Market sentiment and risk appetite also play a significant role in determining currency movements. In times of uncertainty or market volatility, investors often flock to safe-haven assets like the US dollar, driving up its value. Conversely, a positive risk sentiment can lead to a depreciation of the USD as investors seek higher-yielding assets. Keeping an eye on market sentiment indicators can provide valuable insights into potential shifts in the USD’s value.

4. **Inflation Outlook**: Inflation expectations can influence currency valuations, with higher inflation typically leading to currency depreciation. The USD’s rally could be fueled by concerns about rising inflation levels, prompting investors to seek shelter in the currency as a hedge against purchasing power erosion. Monitoring key inflation metrics and the Federal Reserve’s response to inflation dynamics will be crucial in assessing the USD’s potential rally.

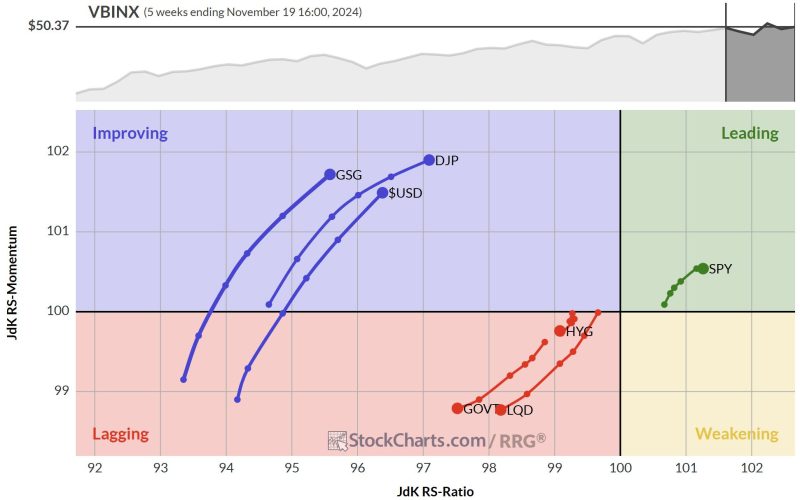

5. **Technical Analysis**: Technical analysis can also provide insights into the potential direction of the USD. Analyzing charts, trendlines, and key support/resistance levels can help identify potential turning points in the currency’s value. Traders often use technical indicators to make informed decisions about their positions in the forex market, factoring in both historical price patterns and current market dynamics.

In conclusion, the US dollar’s prospects for a perfect rally hinge on a complex interplay of factors, including Federal Reserve policies, global economic conditions, market sentiment, inflation outlook, and technical analysis. As investors navigate the evolving economic landscape, staying informed about these key determinants will be crucial in anticipating potential shifts in the USD’s value and positioning portfolios accordingly.