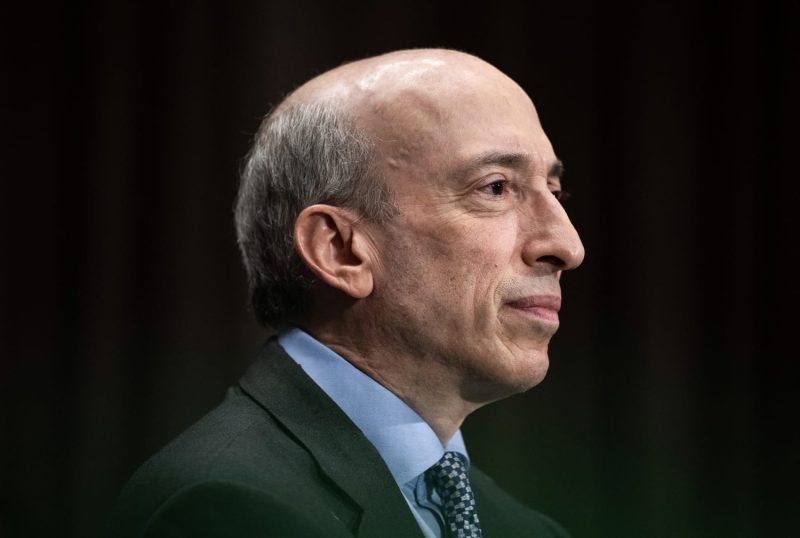

Dramatic Exit: SEC Chair Gary Gensler to Depart on Jan. 20, Opening Door for Trump’s Successor

In a surprising turn of events, Securities and Exchange Commission (SEC) Chair Gary Gensler announced his decision to step down from his position on January 20. Gensler’s departure from the SEC will mark the end of his tenure, which began in April 2021. His resignation opens the door for a potential replacement from the Trump administration.

During his time as SEC Chair, Gary Gensler made significant strides in promoting investor protection and market transparency. Under his leadership, the SEC pursued various regulatory initiatives aimed at safeguarding investors and maintaining fair and efficient markets. Gensler actively advocated for stricter oversight of financial institutions and proposed new rules to address emerging risks in the financial industry.

One of Gensler’s key accomplishments as SEC Chair was the agency’s increased focus on climate-related disclosures. Recognizing the growing importance of environmental, social, and governance (ESG) factors in investment decision-making, Gensler pushed for enhanced disclosure requirements to help investors better assess companies’ climate-related risks and opportunities. His efforts in this area have been widely praised by environmental advocates and investors alike.

In addition to his work on ESG issues, Gensler also spearheaded efforts to reform the market structure and address systemic risks in the financial system. He proposed new regulations to enhance market resilience, tackle market manipulation, and improve transparency in the trading of securities. Gensler’s proactive approach to regulatory reform earned him a reputation as a strong advocate for investor interests and market integrity.

Despite his achievements, Gensler faced challenges during his tenure, including criticism from industry stakeholders and lawmakers. Some market participants raised concerns over the SEC’s aggressive regulatory agenda, arguing that certain rules proposed by Gensler could stifle innovation and hinder market efficiency. Furthermore, Gensler faced scrutiny over his approach to cryptocurrency regulation, with critics questioning the SEC’s enforcement actions against digital asset projects.

As Gary Gensler prepares to step down as SEC Chair, the financial community awaits the appointment of his successor. Speculation is rife that a replacement from the Trump administration could bring about a shift in the SEC’s regulatory priorities and enforcement approach. The incoming SEC Chair will inherit a complex regulatory landscape, with ongoing challenges such as the rise of digital assets, the proliferation of ESG investing, and the need to address systemic risks in the financial system.

In conclusion, Gary Gensler’s impending departure from the SEC marks the end of a transformative era in securities regulation. His tenure was marked by a relentless pursuit of investor protection, market integrity, and regulatory reform. As the financial industry braces for a new era under a Trump replacement, the legacy of Gary Gensler’s regulatory initiatives will continue to shape the future of the securities markets.