Unlocking Financial Success: Mastering Relative Strength and More in Money Management – Part 3

In the realm of finance and investment management, one crucial factor that significantly impacts success is the use of rules-based money management. The application of strict guidelines and strategies in managing funds helps investors navigate the complex waters of the financial market with more method and discipline. In this article, we will delve into the importance of relative strength and other measures in the context of rules-based money management.

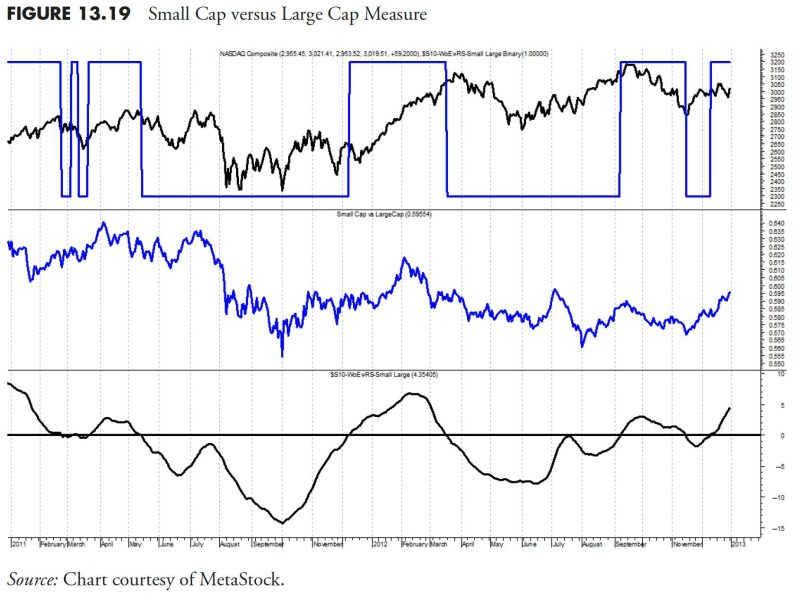

Relative strength, a concept used extensively in technical analysis, plays a pivotal role in assessing the performance of a particular asset or security relative to others in the market. By comparing the strength of a security against its peers or a benchmark index, investors can gauge its momentum and potential for growth. This measure assists in identifying assets with superior performance and those that may underperform, aiding in strategic decision-making in investment portfolios.

Furthermore, relative strength can be a useful tool in trend-following strategies, where investors capitalize on the momentum of assets trending upwards or downwards. By using relative strength rankings, investors can systematically allocate capital to assets with the strongest performance, increasing the likelihood of achieving favorable returns.

Another essential measure in rules-based money management is volatility. Volatility reflects the degree of variation in the price of an asset over time, indicating the level of risk associated with it. Investors often incorporate volatility metrics in their investment strategies to manage risk effectively. By diversifying a portfolio with assets of varying volatility levels, investors can mitigate overall risk exposure and enhance the stability of their investments.

Risk-adjusted returns are also a key consideration in rules-based money management. Evaluating the return of an investment relative to its risk profile provides a more comprehensive assessment of its performance. Measures such as the Sharpe ratio and the Sortino ratio quantify the risk-adjusted return of an asset, helping investors make informed decisions on portfolio allocation.

Moreover, rules-based money management emphasizes the importance of maintaining a disciplined approach to investing. By establishing clear rules and guidelines for entry and exit points, investors can avoid emotional decision-making and adhere to a systematic investment strategy. This disciplined approach enhances consistency in investment performance and minimizes the impact of market fluctuations.

In conclusion, incorporating relative strength, volatility measures, risk-adjusted returns, and maintaining discipline are essential components of rules-based money management. By leveraging these measures effectively, investors can optimize their portfolio performance, manage risk efficiently, and navigate the complexities of the financial market with confidence and precision.