Silver Cross Buy Signals on the Dow (DIA) and Russell 2000 (IWM): What Investors Need to Know

Investors are always on the lookout for signals that can potentially guide their investment decisions, and one of the most respected indicators in the field is the Silver Cross Buy Signal. With the recent emergence of such signals on the Dow (DIA) and Russell 2000 (IWM) indexes, there is a renewed interest and focus on what this could mean for investors.

What is a Silver Cross Buy Signal, and why is it significant? Essentially, a Silver Cross Buy Signal occurs when a short-term moving average crosses above a longer-term moving average. This is often seen as a bullish sign, indicating a potential uptrend in the market. In the case of the Dow and Russell 2000 indexes, the appearance of Silver Cross Buy Signals suggests that these markets may be poised for growth and could present attractive opportunities for investors.

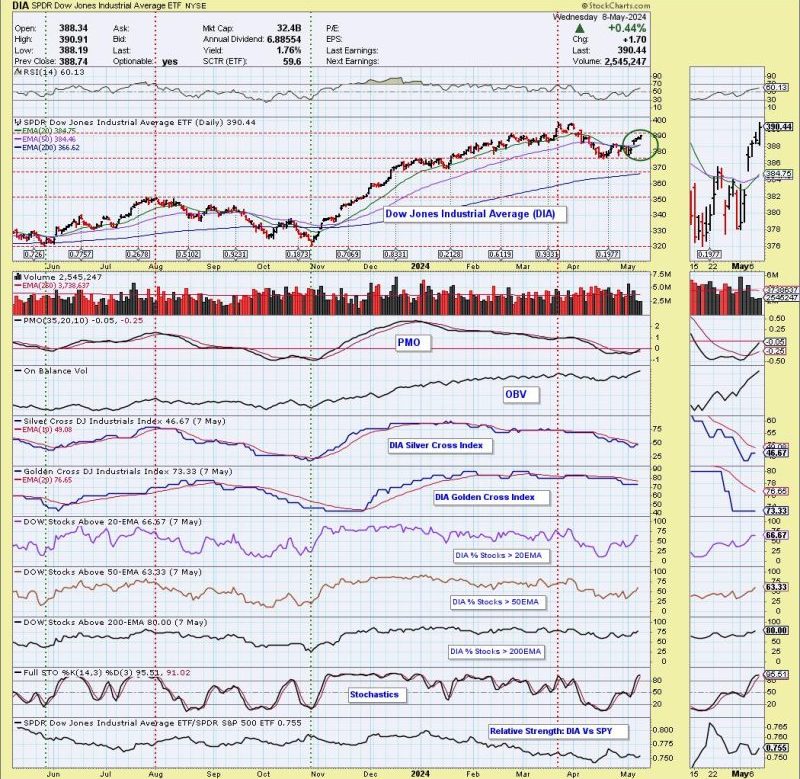

The Dow Jones Industrial Average (DIA) is an index that tracks 30 large and well-established companies, providing a snapshot of the overall health of the stock market. The recent Silver Cross Buy Signal on the DIA indicates that these companies may be experiencing positive momentum and could see an increase in value in the near future. For investors looking to capitalize on this potential growth, it may be a signal to consider adding exposure to DIA-related investments.

On the other hand, the Russell 2000 Index (IWM) offers a broader view, representing around 2,000 small-cap companies. The presence of a Silver Cross Buy Signal on the IWM suggests that smaller companies within this index may be showing strength and could outperform the broader market. This could present an opportunity for investors seeking higher growth potential and willing to take on additional risk.

It’s important to note that while Silver Cross Buy Signals are considered bullish indicators, they are not foolproof guarantees of market performance. Investors should conduct thorough research and consider other factors before making investment decisions solely based on these signals. Market conditions, economic data, geopolitical events, and company-specific news can all influence the direction of the market, and should be taken into consideration alongside technical signals.

In conclusion, the emergence of Silver Cross Buy Signals on the Dow (DIA) and Russell 2000 (IWM) indexes is generating interest among investors looking for potential opportunities in the market. These signals suggest a potential uptrend and growth in these markets, but investors should exercise caution and conduct comprehensive analysis before making any investment decisions. By staying informed and considering a range of factors, investors can make more informed and strategic choices to help grow their portfolios.