Unlock Your Wealth: Mastering Security Ranking Measures in Rules-Based Money Management Part 4

In the world of finance, the concept of rules-based money management has gained significant traction in recent years. By adhering to predetermined, systematic rules and strategies, investors can enhance their decision-making process while minimizing emotional biases and uncertainties. Security ranking measures play a crucial role in this approach, providing investors with a structured framework to assess and prioritize investment opportunities based on specific criteria. Let’s delve deeper into the various security ranking measures commonly used in rules-based money management strategies.

1. **Fundamental Analysis**: Fundamental analysis remains a cornerstone in security ranking measures by evaluating a company’s financial health, performance, and valuation metrics. This method involves scrutinizing aspects such as earnings growth, profit margins, debt levels, and industry comparisons. By focusing on fundamental factors, investors can identify undervalued or overvalued securities, guiding their investment decisions.

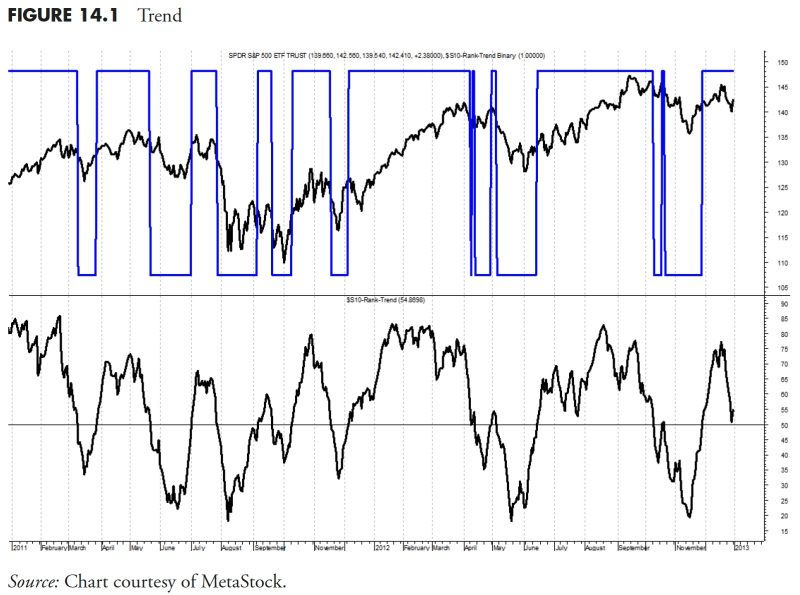

2. **Technical Indicators**: Technical analysis utilizes past market data and price movements to predict future price trends. Common technical indicators include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). Through technical analysis, investors can identify entry and exit points, gauge market momentum, and assess potential price reversals.

3. **Volatility Measures**: Volatility measures play a critical role in security ranking by assessing the level of price fluctuations exhibited by a security. Volatility indicators, such as standard deviation and beta, offer insights into the risk associated with a particular security. High volatility may indicate greater uncertainty and risk, whereas low volatility suggests relative stability.

4. **Risk-Adjusted Returns**: Evaluating risk-adjusted returns is essential in determining the efficiency of an investment. Metrics like Sharpe ratio, Sortino ratio, and Treynor ratio help investors assess the return generated per unit of risk taken. By incorporating risk-adjusted measures into security ranking, investors can compare investments on a level playing field, considering both returns and risk exposure.

5. **Corporate Governance and ESG Criteria**: In an era of increasing emphasis on sustainability and responsible investing, security ranking measures now consider corporate governance practices and environmental, social, and governance (ESG) criteria. Factors like board diversity, executive compensation, environmental impact, and community engagement are evaluated to gauge a company’s long-term sustainability and ethical practices.

6. **Industry and Sector Analysis**: Understanding the dynamics of various industries and sectors is crucial in security ranking. Industry-specific factors, market trends, regulatory changes, and competitive landscape significantly impact a security’s performance. By conducting thorough industry and sector analysis, investors can identify sectoral opportunities or risks, enabling informed investment decisions.

In conclusion, security ranking measures are indispensable tools in rules-based money management strategies, providing investors with a structured framework to evaluate, prioritize, and manage investment opportunities effectively. By integrating fundamental analysis, technical indicators, volatility measures, risk-adjusted returns, corporate governance, ESG criteria, and industry analysis, investors can enhance their decision-making process and achieve their financial objectives in a systematic and disciplined manner. Embracing these security ranking measures empowers investors to navigate the complexities of financial markets with confidence and clarity.