Unleash the Power of Trend-Following in Your Money Management Strategy: Part 8 of Rules-Based Money Management

In the realm of finance and investing, effective money management plays a crucial role in determining success or failure. One proven strategy that has gained traction over the years is trend following. By leveraging trends in financial markets, investors can potentially capitalize on price movements and secure profitable opportunities. In this article, we delve deeper into the concept of trend following and explore practical ways to implement this strategy.

Understanding Trend Following

Trend following is a systematic approach to investing that involves observing and analyzing the directional movement of asset prices over a certain period. The basic premise of trend following is to identify and follow the prevailing trends in the market, aiming to ride the wave of price momentum for potential gains. It operates on the principle that assets tend to move in trends, either upwards (bullish) or downwards (bearish), and that these trends can persist over time.

Implementing Trend Following Strategies

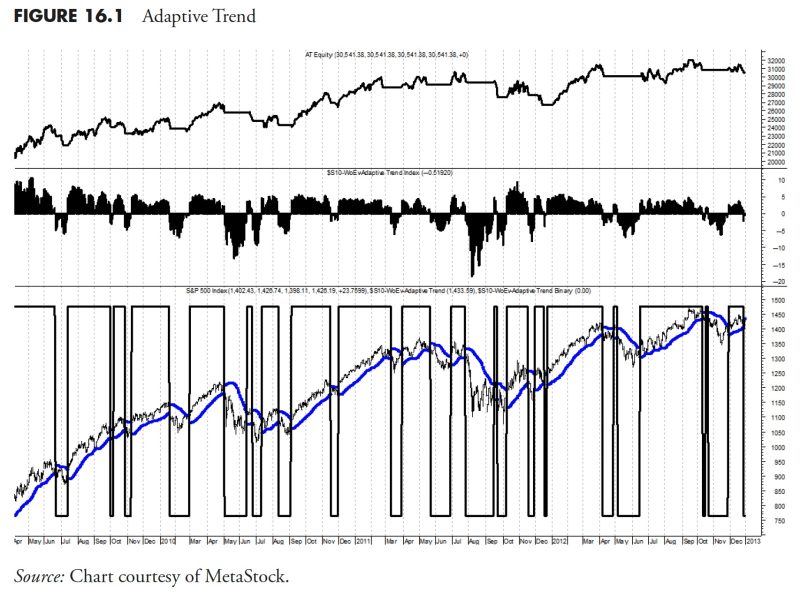

There are various approaches to implementing trend following strategies, with some popular methods including moving averages, trend indicators, and breakout systems. Moving averages, for instance, involve tracking the average price of an asset over a specific period to determine the trend direction. Investors may use simple moving averages (SMA) or exponential moving averages (EMA) to identify trend reversals and potential entry or exit points.

Another common tactic is to use trend indicators like the Average Directional Index (ADX) or Relative Strength Index (RSI) to gauge the strength of a trend and assess potential trading opportunities. These indicators help investors identify overbought or oversold conditions, providing valuable insights into market dynamics. Breakout systems, on the other hand, focus on entering trades when prices break above or below predefined levels, signaling a potential trend reversal or continuation.

Risk Management and Position Sizing

Incorporating risk management principles into trend following strategies is essential to protect capital and optimize returns. Effective risk management involves setting stop-loss orders to limit potential losses and adhering to predetermined position sizing rules. By defining the maximum percentage of capital to risk on each trade, investors can mitigate downside risks and maintain a disciplined approach to trading.

Furthermore, diversification across different asset classes and markets can help reduce correlation risk and enhance portfolio resilience. By spreading investments across multiple sectors or regions, investors can balance exposure to various market trends and minimize the impact of individual asset performance on their overall portfolio.

Monitoring and Adjusting Strategies

Regularly monitoring market conditions and adjusting trend following strategies accordingly is crucial to staying adaptive and responsive to changing trends. Market environments can shift rapidly, requiring investors to reassess their positions and make informed decisions based on current data and analysis.

Additionally, backtesting historical data and evaluating the performance of trend following strategies can provide valuable insights into their effectiveness and identify areas for improvement. By reviewing past trades and analyzing key metrics such as risk-adjusted returns and drawdowns, investors can fine-tune their strategies and enhance overall portfolio performance over time.

In conclusion, trend following is a powerful tool in the investor’s arsenal, offering a structured approach to navigating dynamic financial markets and capturing profitable opportunities. By understanding the principles of trend following, implementing effective strategies, managing risks, and remaining agile in response to market changes, investors can optimize their investment outcomes and potentially achieve long-term success in their financial endeavors.