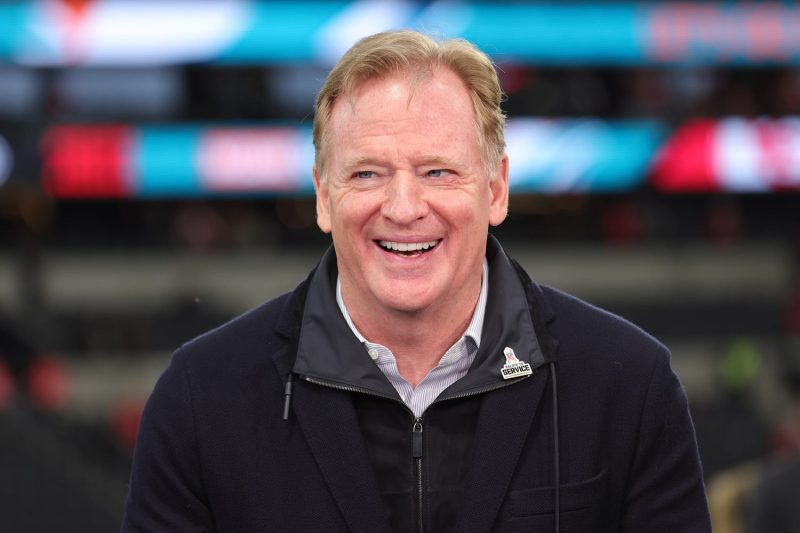

NFL Commissioner Roger Goodell Welcomes Private Equity Teams Owning Up to 10% Stake in League

The NFL Open to Private Equity Team Ownership of Up to 10%, Commissioner Roger Goodell Says

The landscape of professional sports team ownership in the United States has been traditionally dominated by wealthy individuals and families who invest their personal funds into owning a franchise. However, in recent years, there has been growing interest from private equity firms looking to acquire stakes in sports teams. The National Football League (NFL) is now considering opening its doors to private equity ownership, with Commissioner Roger Goodell announcing that the league is open to allowing up to 10% of a team to be owned by private equity investors.

This potential shift in ownership structure could have significant implications for the NFL and the world of professional sports as a whole. Private equity firms are known for their aggressive investment strategies and focus on maximizing returns for their investors. Bringing private equity into the mix could inject fresh capital into NFL teams and potentially lead to innovations in the business operations of these franchises.

One of the key potential benefits of private equity ownership in the NFL is the infusion of capital that these firms could provide. Professional sports franchises are expensive to run, with costs related to player salaries, stadium maintenance, and marketing continually on the rise. Private equity investment could help teams keep up with these escalating costs and ensure their long-term financial stability.

Another advantage of private equity ownership is the expertise and resources that these firms bring to the table. Private equity investors are seasoned professionals who are adept at analyzing business opportunities and making strategic decisions to maximize returns. By partnering with private equity firms, NFL teams could gain access to valuable insights and best practices from the world of finance and business.

However, there are also potential drawbacks to allowing private equity ownership in the NFL. Critics argue that private equity investors may prioritize short-term profits over the long-term success and stability of the team. This could lead to decisions that are aimed at generating quick returns, rather than building a sustainable and successful sports franchise.

Moreover, private equity ownership could potentially lead to increased commercialization and corporatization of the NFL. As private equity firms seek to maximize profits, they may push for more aggressive marketing campaigns, sponsorship deals, and commercial tie-ins, which could change the traditional fan experience and culture of the sport.

In conclusion, the NFL’s potential opening to private equity ownership could mark a significant shift in the world of professional sports team ownership. While there are potential benefits to be gained from private equity investment, such as increased capital and access to expertise, there are also legitimate concerns about the impact of private equity on the long-term stability and integrity of the league. As the NFL weighs the pros and cons of allowing private equity ownership, it will be essential for the league to carefully consider the implications of this decision on the future of the sport.