Stay alert as NIFTY continues to stray far from average levels in the upcoming week!

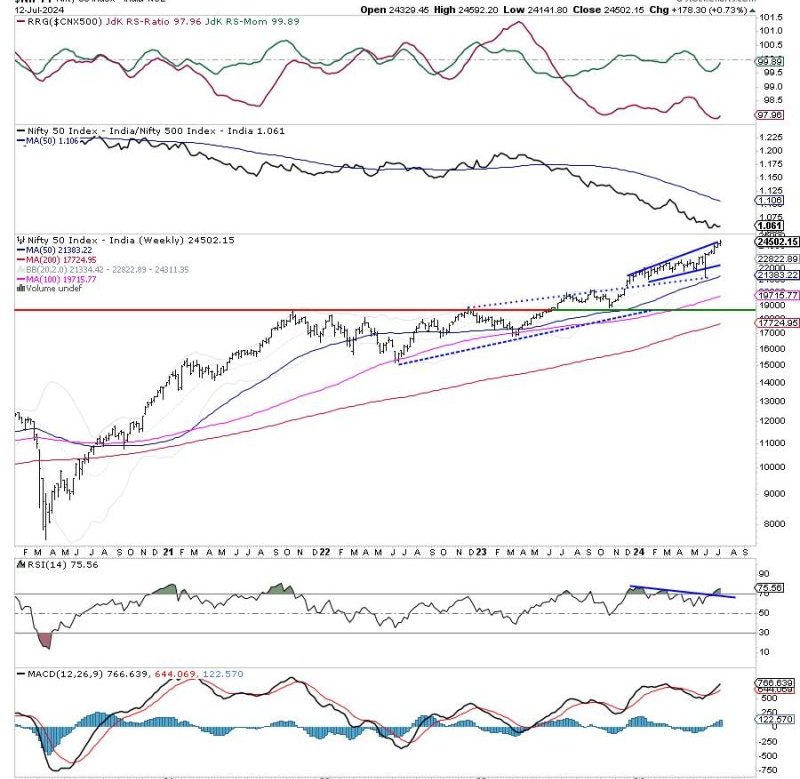

The Nifty stayed significantly deviated from its mean value last week, prompting investors to exercise caution at higher levels. As we look ahead to the upcoming week, it is essential to analyze the current market conditions and be vigilant in our approach towards trading and investment decisions.

One key factor to consider is the Nifty’s distance from its mean value. By staying significantly deviated, the index indicates potential market volatility and uncertainty. This deviation implies that the market may be overextended, making it susceptible to corrections or reversals in the near future. Therefore, investors should remain cautious and closely monitor market movements to protect their investments from sudden downturns.

Another important aspect to watch out for is any upcoming major economic events or policy announcements that can impact market sentiment. These events could include central bank meetings, economic data releases, geopolitical developments, or corporate earnings reports. Understanding the potential impact of such events on the market can help investors make informed decisions and adjust their trading strategies accordingly.

Furthermore, keeping track of technical indicators and market trends can provide valuable insights into the prevailing market sentiment and potential price movements. Traders should analyze key support and resistance levels, moving averages, and other technical signals to identify optimal entry and exit points for their trades. By combining technical analysis with fundamental factors, investors can enhance their trading strategies and improve their risk management.

Additionally, it is crucial to diversify your portfolio and avoid putting all your eggs in one basket. Diversification helps spread risk across different asset classes and reduces the impact of market fluctuations on your overall investment portfolio. By investing in a mix of stocks, bonds, commodities, and other financial instruments, you can achieve a balanced risk-return profile and enhance the resilience of your portfolio against market uncertainties.

In conclusion, staying vigilant at higher levels and being proactive in monitoring market conditions are crucial for successful trading and investment outcomes. By understanding the current market dynamics, assessing potential risks, and adopting a prudent investment strategy, investors can navigate through volatile market environments and achieve their financial goals effectively.

As we move forward into the upcoming week, let us remain cautious, well-informed, and ready to adapt to changing market conditions to make prudent investment decisions and capitalize on new opportunities. By staying proactive and disciplined in our approach, we can mitigate risks and maximize returns in the dynamic world of financial markets.