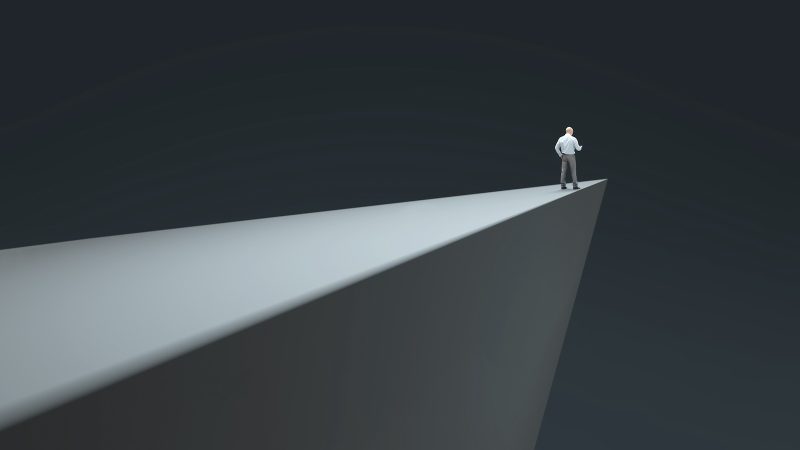

In the world of finance and investing, it is crucial to pay attention to critical levels that could potentially dictate market movements. The NASDAQ, a popular stock index heavily weighted towards technology companies, is currently on the edge, facing potential shifts that could have significant ripple effects in the broader market. Analyzing key levels and trends is essential for investors and traders looking to make informed decisions in such a dynamic and ever-changing environment. Let’s delve into the critical levels to watch as the NASDAQ teeters on the edge.

1. **Support and Resistance Levels**: Support and resistance levels are key indicators of price levels where a stock index is expected to face buying or selling pressure. For the NASDAQ, important support and resistance levels play a crucial role in understanding market sentiment. Traders often look at these levels to determine potential entry and exit points for their positions.

2. **Moving Averages (MA)**: Moving averages are widely used technical indicators that smooth out price data to identify trends over a specific time frame. The NASDAQ’s moving averages, such as the 50-day and 200-day MAs, can signal strength or weakness in the market. Crossovers between these averages can provide valuable insights into potential trend reversals.

3. **Volatility and Volume**: Volatility, represented by indicators such as the VIX, reflects the degree of variation in trading prices over a specific time period. High volatility can signal uncertainty and potential market swings. Similarly, trading volume, the number of shares traded in a period, is essential for confirming price movements. Unusual spikes in volume can provide clues about market direction.

4. **Technical Patterns**: Chart patterns, such as head and shoulders, triangles, and flags, can offer valuable insights into potential price movements. Identifying these patterns on the NASDAQ chart can help traders anticipate future trends and make informed decisions. Understanding technical patterns can provide a roadmap for navigating market uncertainties.

5. **Fundamental Analysis**: While technical analysis is essential for short-term trading decisions, fundamental analysis is crucial for understanding the broader market landscape. Factors such as economic data, company earnings, interest rates, and geopolitical events can significantly impact the NASDAQ’s performance. Keeping abreast of fundamental developments is key to making informed investment choices.

6. **Sentiment Indicators**: Market sentiment plays a vital role in driving stock prices. Indicators such as the put/call ratio, investor surveys, and news sentiment can provide insights into market psychology. Extreme bullish or bearish sentiment levels can signal potential market reversals. Monitoring sentiment indicators alongside technical and fundamental analysis is essential for a comprehensive market outlook.

In conclusion, keeping a close eye on critical levels and indicators is paramount when navigating the complexities of the financial markets. The NASDAQ, in particular, presents a myriad of opportunities and challenges for investors and traders alike. By staying informed and analyzing key levels diligently, market participants can position themselves strategically and adapt to changing market conditions with confidence. Adhering to a well-rounded approach that combines technical, fundamental, and sentiment analysis is essential for successfully navigating the NASDAQ and exploiting potential opportunities in the market.