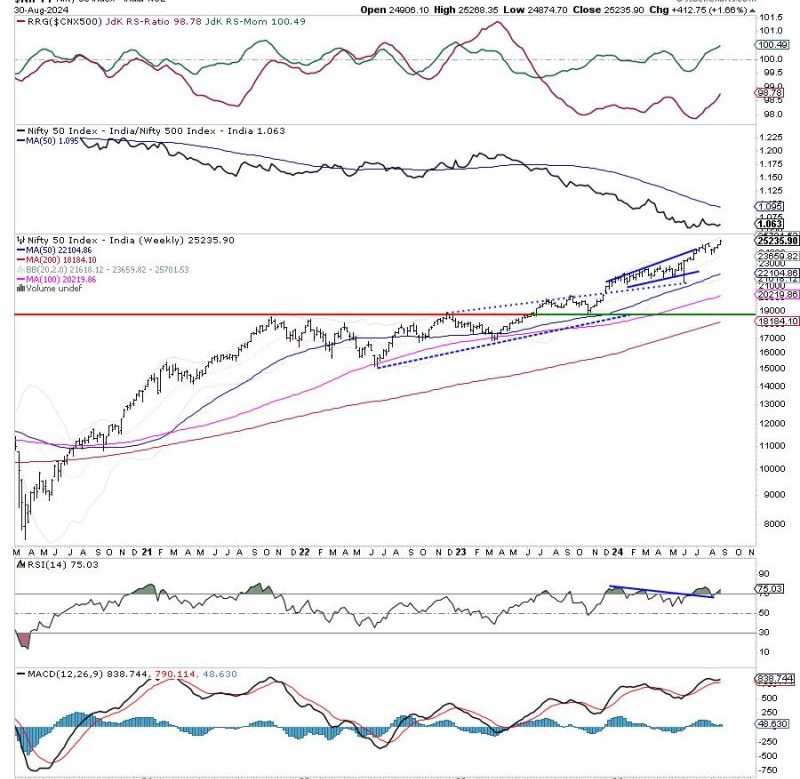

Week Ahead: Uptrend Stays Intact for Nifty, RRG Shows Distinctly Defensive Setup

The Indian stock market remains on a positive trajectory as the Nifty index continues to uphold its uptrend. However, recent signs on the Relative Rotation Graph (RRG) indicate a notably defensive setup for certain sectors. This dynamic suggests that while the overall market may be bullish, there are pockets of weakness that investors should be wary of.

In the week ahead, investors should keep a close eye on sectoral rotations and potential shifts in market sentiment to make informed decisions. By understanding the underlying dynamics at play, investors can position themselves strategically to capitalize on opportunities while also managing risks effectively.

One of the key sectors to monitor is the IT sector, which has shown strength in recent weeks. Companies in this sector have been benefiting from global demand for digital services and technology solutions. As remote work and digital transformation trends continue to drive growth, IT stocks are expected to remain robust in the near term.

On the other hand, the banking sector is facing headwinds due to concerns around asset quality, loan restructuring, and economic uncertainties. While certain banking stocks may be undervalued and present value buying opportunities, investors should carefully assess individual companies’ fundamentals before making investment decisions.

The pharmaceutical sector is another area of interest, given its defensive characteristics and potential for growth amidst the ongoing global health crisis. Companies in the pharma sector have been at the forefront of vaccine development and are likely to benefit from sustained demand for healthcare products and services.

Overall, investors should adopt a cautious yet opportunistic approach in the week ahead. By staying informed about market developments and sectoral rotations, investors can navigate the stock market with confidence and resilience. Remember, the key to successful investing lies in understanding market dynamics and making well-informed decisions based on sound analysis and research.