Market Continues to Soar Despite Overvaluation Concerns following 2024 Q2 Earnings

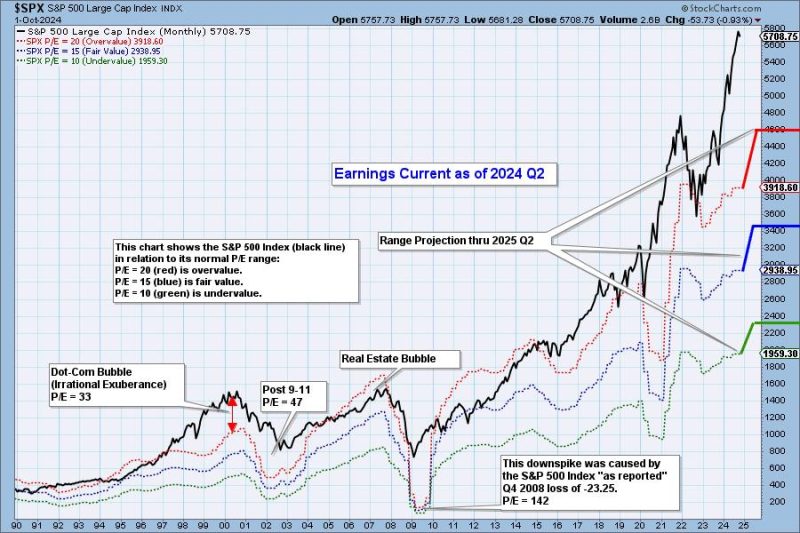

In the latest analysis conducted by financial experts, it has been observed that the market remains significantly overvalued as of the second quarter of 2024. This assessment has raised concerns among investors and analysts as they try to navigate the current landscape of the financial markets.

One of the key indicators of an overvalued market is the price-to-earnings (P/E) ratio, which is used to evaluate the valuation of a company’s stock by comparing its market price per share to its earnings per share. A high P/E ratio suggests that the market is anticipating high future earnings growth, which may not be supported by the company’s current financial performance.

Furthermore, the cyclically adjusted price-to-earnings (CAPE) ratio, which adjusts the traditional P/E ratio for inflation and business cycle effects, also points towards an overvalued market. Historically, high CAPE ratios have been associated with market corrections and periods of low returns for investors.

Another concerning factor is the elevated levels of corporate debt within the market. Companies have increasingly relied on debt to fund their operations and expansion, which can pose risks in an economic downturn or a rising interest rate environment. High debt levels can constrain companies’ ability to invest in growth opportunities and weather financial headwinds.

Moreover, the current low interest rate environment has fueled investor appetite for riskier assets in search of higher returns. This search for yield has led to inflated asset prices and increased market speculation, which can exacerbate market volatility and systemic risk.

In addition, geopolitical tensions and global economic uncertainties have added another layer of complexity to the market dynamics. Factors such as trade disputes, political instability, and supply chain disruptions can disrupt global markets and investor sentiment, leading to increased market volatility and risk.

As investors navigate through these challenging market conditions, it is crucial to maintain a diversified portfolio, conduct thorough research, and exercise caution when making investment decisions. While it is impossible to predict market movements with certainty, being proactive in risk management and staying informed about market trends can help investors mitigate potential losses and capitalize on opportunities in a volatile market environment.

In conclusion, the current market situation presents a challenging landscape for investors, with indicators pointing towards an overvalued market. By staying vigilant, conducting thorough analysis, and remaining disciplined in their investment approach, investors can navigate through these uncertainties and position themselves for long-term financial success in the ever-evolving financial markets of 2024.