Navigating the Market: A Strategic Look at This Week’s Action with a Focus on Nifty

In the world of financial markets, understanding the movements and trends can often seem like a daunting task. Investors are constantly seeking insights and perspectives that can help them make informed decisions. One approach that has gained popularity is analyzing market moves from different angles to gain a comprehensive view of the situation.

The upcoming week ahead brings with it the potential for significant market movements, particularly in the Nifty index. By putting these moves into perspective and viewing them from various angles, investors can better navigate the uncertainties and risks that come with trading and investing.

One crucial angle to consider when evaluating market moves is the historical context. Looking back at past trends and patterns can provide valuable insights into how the market may behave in the future. By analyzing historical data, investors can identify potential support and resistance levels, as well as key turning points that could impact the market’s direction.

Another important angle to consider is the broader market sentiment. The mood of the market can often influence trading decisions and impact price movements. By monitoring indicators such as investor sentiment, market breadth, and volatility, investors can gauge the overall sentiment in the market and adjust their strategies accordingly.

Additionally, it is essential to keep a close eye on external factors that could influence market moves. Economic data releases, geopolitical events, and central bank announcements are just a few examples of external factors that can have a significant impact on the market. By staying informed about these developments and understanding how they can impact market dynamics, investors can position themselves to take advantage of potential opportunities or mitigate risks.

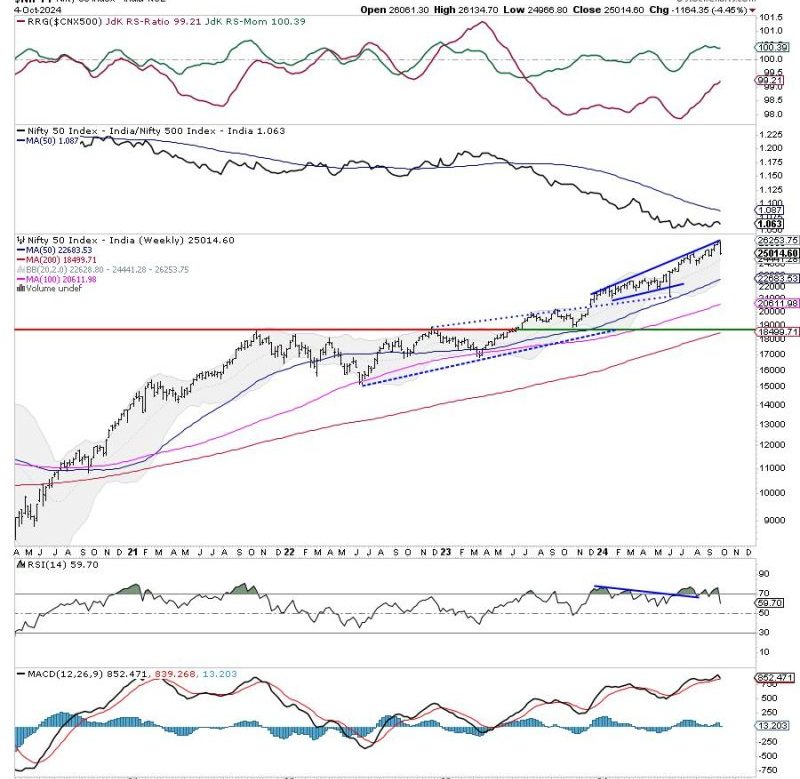

Technical analysis is another angle that investors can use to interpret market moves. By studying price charts, trends, and technical indicators, investors can identify key levels of support and resistance, as well as potential entry and exit points for trades. Technical analysis can provide valuable insights into market psychology and help investors make more informed trading decisions.

Ultimately, by approaching market moves from different angles and considering a variety of perspectives, investors can gain a more comprehensive understanding of the market dynamics. This multifaceted approach can help investors make better-informed decisions and navigate the complexities of the financial markets with greater confidence and success.