Unveiling the Mystery: SMH Outshines SOXX in the Semiconductor ETF Showdown!

The semiconductor industry has long been viewed as a significant player in the global economy, primarily due to its impact on various sectors like technology, manufacturing, and healthcare. In the midst of the ongoing market turbulence caused by factors such as the global chip shortage and geopolitical tensions, the performance of Semiconductor ETFs like SMH and SOXX has been closely observed and analyzed.

SMH, the VanEck Vectors Semiconductor ETF, and SOXX, the iShares PHLX Semiconductor ETF, represent two of the most popular ETFs that investors look to for exposure to the semiconductor industry. Despite both ETFs having a strong focus on semiconductor companies, their performance in recent times has diverged to some extent, prompting questions about the factors influencing their movements.

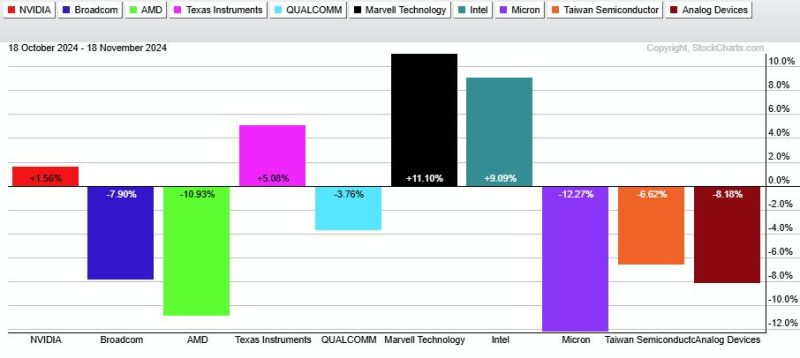

One notable observation is that SMH has outperformed SOXX in the current market conditions. This difference in performance can be attributed to several factors that impact the composition and weighting of the ETFs. SMH, for instance, has a larger exposure to key players in the semiconductor industry, which could potentially shield it from some of the volatility affecting the sector.

Furthermore, the weighting of individual stocks within each ETF can also play a significant role in determining their performance. SMH’s allocation to key semiconductor manufacturers might provide it with a competitive edge over SOXX in times of market uncertainty. On the other hand, SOXX’s composition could be more vulnerable to fluctuations in specific segments of the semiconductor industry.

Another aspect to consider is the broader economic context in which both ETFs operate. The semiconductor industry is heavily influenced by global economic trends and geopolitical developments, which can impact the demand for semiconductor products and consequently affect the performance of ETFs like SMH and SOXX.

Moreover, investor sentiment and market dynamics can also contribute to the differences in performance between these two ETFs. While both SMH and SOXX provide exposure to the semiconductor industry, fluctuations in investor behavior and market sentiment can lead to divergences in their respective performances.

In conclusion, the tale of these two Semiconductor ETFs, SMH and SOXX, is a reflection of the complexities and nuances that define the semiconductor industry and its impact on the broader market. By understanding the factors influencing their performance, investors can make informed decisions about where to allocate their resources in the ever-evolving landscape of the semiconductor market.