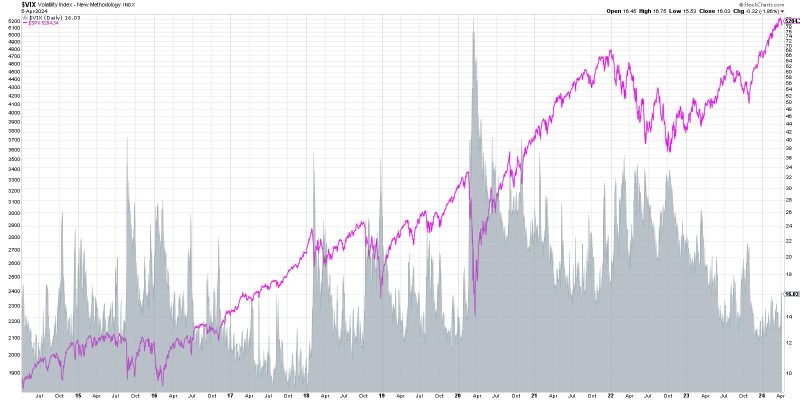

VIX Spikes Above 16: Is This the End?

The recent spike in the CBOE Volatility Index (VIX) above the critical threshold of 16 has stirred concerns among investors and analysts alike. The VIX, often referred to as the fear gauge, measures market volatility based on the S&P 500 options prices. A level above 16 is typically seen as a sign of increased uncertainty and potential market turbulence. Let’s delve into the implications of this spike and what it could mean for investors.

Market Volatility: An Overview

Volatility is an essential aspect of financial markets, reflecting the degree of variation in asset prices over a specific period. While some investors may view volatility as a source of opportunity for higher returns, excessive volatility can lead to financial instability and market crashes. The VIX serves as a barometer of market sentiment and is closely watched by traders and analysts to gauge investor fear and uncertainty.

Implications of a High VIX

A VIX reading above 16 is considered elevated and may signal a higher level of perceived risk in the market. It suggests that investors are willing to pay more for options as a form of protection against potential downside moves in the stock market. Historically, spikes in the VIX have coincided with market sell-offs, as heightened uncertainty can trigger panic selling and exacerbate downside pressure on equities.

Causes of the VIX Spike

Several factors can contribute to a spike in the VIX, including geopolitical tensions, economic data releases, corporate earnings reports, and global events. The recent surge in the VIX could be attributed to concerns over inflation, rising interest rates, geopolitical risks, or a combination of these factors. Uncertainty surrounding monetary policy decisions by central banks can also drive volatility in the market.

Investor Response

For investors, a spike in the VIX may prompt a reassessment of risk exposure and portfolio allocation. Those with a higher risk tolerance may see opportunities to capitalize on short-term market fluctuations, while more conservative investors may opt to reduce exposure to equities and increase holdings in defensive assets like bonds or gold. Implementing hedging strategies such as buying put options or diversifying across asset classes can help mitigate the impact of market volatility.

The Long-Term Outlook

While spikes in the VIX can rattle markets in the short term, it is essential to maintain a long-term perspective when navigating periods of heightened volatility. Historically, markets have shown resilience and have often rebounded from bouts of turbulence. Investors should focus on maintaining a diversified portfolio, adhering to their investment objectives, and staying informed about market developments to make well-informed decisions in changing market conditions.

In conclusion, the recent spike in the VIX above 16 has raised concerns about potential market turbulence and increased uncertainty. Understanding the implications of elevated volatility and being prepared to adjust investment strategies accordingly can help investors navigate through volatile market environments. By staying vigilant, diversifying portfolios, and staying informed, investors can better position themselves to weather market fluctuations and achieve their long-term financial goals.