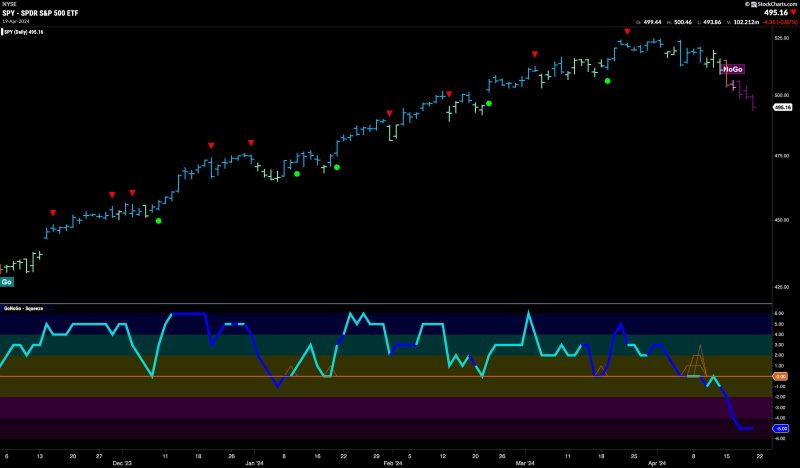

Equities Struggle in Strong NoGo as Materials Try to Curb the Damage

Within the volatile landscape of the financial markets, equities are facing challenges as they navigate through what seems to be a strong NoGo phase. This turmoil is particularly evident in the materials sector, which is attempting to mitigate the damage caused by the current market conditions.

The materials sector, encompassing industries such as mining, chemicals, and forestry, is a critical component of the global economy. As the backbone of various supply chains, materials companies play a significant role in supporting other sectors, including construction, manufacturing, and infrastructure development.

One of the primary reasons for the struggles faced by equities within the materials sector is the inherent cyclicality of the industry. Demand for materials is closely tied to economic activity, with fluctuations in global GDP directly impacting the performance of materials companies. In times of economic uncertainty or downturns, such as the current situation with the ongoing COVID-19 pandemic, materials stocks tend to underperform as investors become wary of the sector’s prospects.

Moreover, the materials sector is also heavily influenced by commodity prices, which can be highly volatile and subject to external factors such as geopolitical tensions, supply chain disruptions, and changes in regulatory environments. Fluctuations in key commodities, such as metals, minerals, and agricultural products, can have a significant impact on the profitability and stock prices of materials companies.

Amidst these challenges, materials companies are implementing various strategies to navigate the current turbulent market conditions. Many firms are focusing on cost-cutting measures, improving operational efficiencies, and diversifying their product offerings to minimize risks and strengthen their competitive positions. Additionally, some companies are investing in innovation and technological advancements to boost productivity and enhance sustainability practices, aligning with growing ESG (Environmental, Social, and Governance) considerations among investors and stakeholders.

In conclusion, while equities in the materials sector are indeed facing headwinds in the current NoGo phase, there are opportunities for companies to adapt and thrive amidst the challenges. By embracing strategic reforms, fostering resilience, and staying attuned to market dynamics, materials companies can position themselves for long-term success in an ever-evolving global economy.